Checking Account

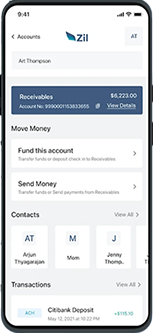

Checking Account that is fee-free and easy to manage can be opened in minutes with the cloud-based platform. Create multiple accounts to handle incoming and outgoing payments and simplify transactions. Ensure cost-efficiency with zero monthly fee, no maintenance fee and no minimum balance requirements. Also, make payments via ACH and wire easily.

Zil US powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Convenient Checking Account

Open a checking account from anywhere easily and manage your business payments without hassle. You don’t have to be physically present in the US to open your checking account – which allows you to complete both domestic and international transactions effortlessly. Enjoy the convenience offered by Zil.US and meet your business needs.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

Create Virtual Cards Online

With Zil.US, users can create virtual cards to make secure payments online. Physical cards are slowly becoming outdated and their digital versions offer more security and ease of use. Make purchases without exposing your account details and even set spending limits on the cards. Make your card inactive at any moment for better control.

Easy to Access

High Security

Easy Payment

Online Payments

Online payments can be done with a few clicks through the cloud based platform. Simply Log In, navigate to the Pay section and choose your payment method- ACH, wire, check mail or virtual card. With these options, businesses can improve the payment process. Vendors and employers can be paid on time with ease.

Digital Wallet

Zil.US offers a digital wallet from which you can make ACH and domestic wire transfers. You can fund the wallet from a checking account and use it for quick transactions. The platform allows you to go completely digital, avoiding traditional payment methods. Small business owners can depend on the cloud-based platform for secure online payments.

FREQUENTLY ASKED QUESTIONS

What is a checking account?

A checking account is used to manage day to day expenses and transactions. Zil.US allows you to open a fee-free online checking account in minutes. You can also make ACH and wire transfers at affordable costs.

Are Checking Accounts Free?

All checking accounts are not free but the one offered by Zil.US is totally free. There is no initial deposit or minimum balance requirements, monthly fee or other hidden fee that will drain your funds.

How many Checking Accounts Should I have?

You can have multiple checking accounts with Zil.US. The platform allows you to create different accounts for your business needs at no extra cost. The platform also allows you to create virtual cards and provides a digital wallet.

Checking Account vs Savings Account

A checking account is used to manage daily expenses while a savings account is for long-term savings. You can open an online checking account for small business with Zil.US.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.