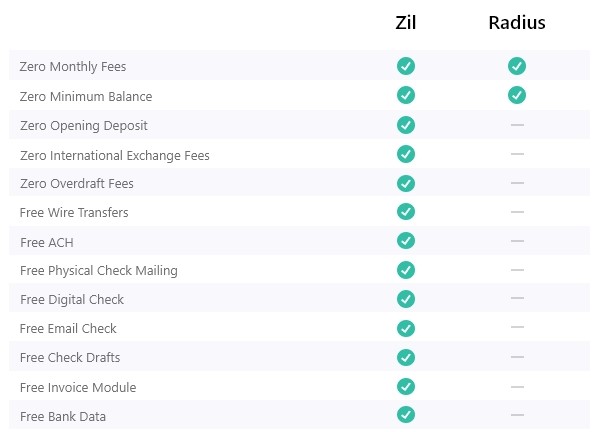

Founded in 1987, Radius Bank, now Lending Club Banking, is a Boston-based online bank that offers full-service banking solutions for individuals and businesses. Zil.US offers several different banking services, including free ACH and Wire transfers, one of the best alternatives to Radius Bank. They also provide check drafts for your convenience, as well as eChecks which are perfect if you want to make sure that the funds reach their destination quickly without having any chance of being lost along the way.

Why Do We Need an Alternative for Radius Bank?

- The high-yield savings account requires a balance of at least $25,000 to earn the highest interest tier. Rewards checking is only accessible for those with balances over 100k to receive the best rates.

- Radius Bank’s savings rates do not compare well with what the top online banks in this market are currently offering. The bank’s only savings account option, the high-yield savings account, is not competitive with other high-yield options. You can earn up to 0.25% APY on balances of $25K or more, which is not great given how many banks offer better returns for your money.

- The lack of physical branches is one drawback to banking with this company.

- The $5 daily overdraft fee is not typical of every online bank.

Does Radius Bank Require a Minimum Deposit?

Radius Bank requires a minimum deposit of $100 as an opening deposit. However, the essential checking account holds daily limits on transactions, and it charges monthly fees. But, Zil.US offers free accounts with no requirements or limitations for users to access their money throughout any given month.

Why Zil.US?

Zil.US business checking account is the perfect solution for your company to maintain a safe and sound financial position. You can focus on what matters – running day-to-day operations without worrying about expensive penalties with no hidden fees.

Zil.US might be the perfect fit if you are looking for a low-maintenance checking account that offers free ACH and wire transfers. The company’s no monthly maintenance fees make it an attractive alternative to Radius Bank with its $10 fee per month if your balance does not exceed $500 at the end of each statement cycle.

Also, there is an additional charge when making transactions outside those limits but do not worry; we will tell you all about these delightful extras shortly!