Expense cards are becoming increasingly popular as a way to receive money. They work just like credit cards, but instead of borrowing money, you use your checking or savings account to fund the purchase. But what if you need to transfer money from your card into a cloud bank account, it can be difficult and time-consuming. Luckily, you have got Zil.US!

Zil.US’s new feature allows you to transfer money from any card directly to your Zil.US account. This cloud banking feature from Zil.US provides a secure, quick, and easy way for businesses to manage their daily transactions.

Expense card at a glance

- Expense cards eliminate the need to carry cash or physical checks to make purchases, and they can also be used at ATMs to withdraw cash.

- Expense card purchases can usually be made with or without a personal identification number (PIN).

- Some cards offer reward programs, similar to credit card reward programs, such as 1% back on all purchases.

Why should you use a Card to receive Money?

There are many reasons why you should consider using a card to receive money. Here are just a few:

Fast and easy – Sending money with a card is fast and easy. All you need is your bank account and the routing number for the card that you want to use.

Secure – Expense cards are one of the safest ways to send money. Your credit card information is never shared with the bank that issued your card.

Cost – Many times, using a card is cheaper than using other methods of transferring money, such as sending checks or wiring money.

Multiple Accounts – Many people have multiple accounts with different banks so they can easily receive money from various sources.

No Overdraft Fees – If you have a low balance on your card, you won’t have to worry about overdraft fees.

How to get started with receiving money from a Card to your Zil.US account

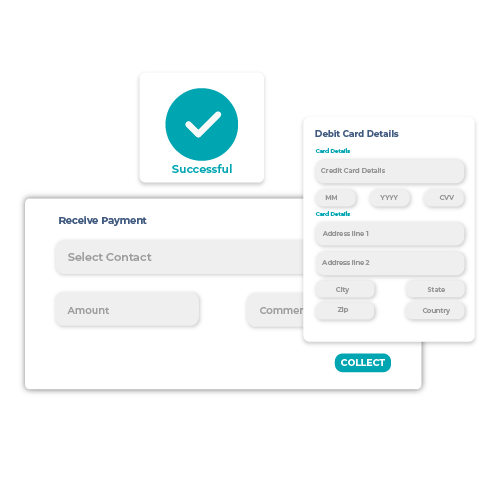

The steps to follow while using a card to transfer money to your Zil.US account are:

- Sign in to Zil.US

- Select ‘Cloud Banking’.

- Select the Zil.US account to which you want to move funds.

- Select ‘Receive Payments’ from the cloud accounts tab.

- Click on ‘pull from card’.

- Enter the contact details and the card details.

Once you have these things set up, it’s easy to start receiving money from your card.

Enter the amount to be transferred and click on ‘collect’ to receive money to your Zil.US account.

How is a card different from a credit card?

In the case of a card, you use the money from your own bank account; while in the case of a credit card, you are receiving the credit from your bank, which you will have to repay at a later date with interest.

Is there any limit on the number of transactions I can make?

No, Zil.US doesn’t make any restrictions on the number of transactions. But your debit provider may have transaction limits.

How long does it take to transfer funds from your card to your cloud bank account?

It hardly takes a minute’s time to do the fund transfers. All that a user needs to do is follow the simple procedures mentioned above.

Transferring money from your business bank account to a cloud banking service had been a time-consuming process, but with Zil.US’s new feature, managing finances has now become easier. Now you can transfer money between your card and your Zil.US account – all without a single stamp in the mail!