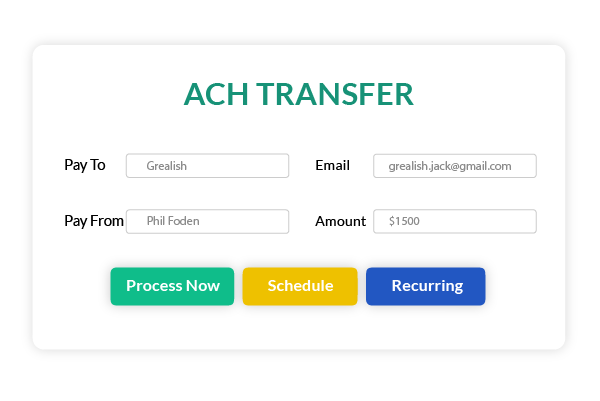

ACH is one of the popular types of payment methods that are used by many. It usually takes more time to process and send money, which disappoints some people, but NACHA, the overseer of ACH transfer, have introduced same-day-ACH, which will transfer money even faster than normal ACH. Zil.US, a cloud-based online bank, provides you and your business with an ACH transfer for reasonable fees in your business checking account.

ACH Network

The National Automated Clearing House Association (NACHA) oversees the ACH network, ACH transactions, such as credit and debit transactions, recurring and one-time payments, government, consumer, and business-to-business transactions, foreign payments, and payments as well as payment-related information, are used for direct deposit and direct payment. Businesses also use ACH to pay for online and telephone orders and when they charge customers’ credit cards directly.

How long does an ACH bank transfer take?

ACH bank transfers take a few days to process; the transfer takes about 3-5 business days to complete. This is because, unlike wire transfers, which are sent quickly, the ACH network transmits payments in batches. Financial institutions can have ACH credits delivered and processed in one or two business days. However, ACH debit transactions must be handled the following business day.

Same Day ACH

In 2010, NACHA tried getting banks to offer rapid services. There was some resistance to this because the idea had taken so long to catch on. Some bank officials say the new services won’t be provided. Launched by NACHA is Same-day ACH. Almost all ACH payment types, including debits and credits, will be qualified for same-day processing.

Following consideration of member feedback, NACHA has suggested new possibilities for Same-Day ACH reconciliation. The following is included in the proposal:

- Electronic transactions, such as those made with debit and credit cards, are settled three times a day: in the morning, in the middle of the day, and in the evening.

- If your home sale is international or costs more than $25,000, same-day settlement is not an available option.

- All receiving institutions (banks, etc.) would need to update their systems.

- Based on the inverse relationship between the two numbers, the originating institution (ODFI) will be charged a predicted fee for these updates, which will decrease as the number of transactions grows.

Advantages of Same-Day-ACH

- Payment of insurance claims, payments for disaster relief, and other returns and reimbursements are made quickly.

- Faster payments for payroll and invoices.

- Quicker collection of funds for check conversion.

- Payment of insurance claims, payments for disaster relief, and other returns and reimbursements made Faster payment of bills on or after the due date.

NACHA Role

NACHA oversees the growing ACH Network, the payment system that powers secure, quick, and efficient direct deposits and payments that may be made to any bank or credit union account in the United States. NACHA creates guidelines and standards, offers business solutions, and offers counselling, accrediting, and educational services. The association also brings together many organizations to develop guidelines and standards that will assist several businesses involved in the payments ecosystem, such as healthcare organizations and Electronic Funds Transfer (EFT) and Electronic Benefits Transfer (EBT) firms.

If you want to transfer money using ACH, give Zil.US a try our platform also provides same-day-ACH without wasting your time. The era of online banking is upon us, start using Zil.US and see how this will change your business finance for the better. Online bank like our platform provides you with features like wire transfer, check printing, and other features. You don’t need to be afraid about ACH transfer, NACH oversees the ACH transfer, so there won’t be any fear of losing your money.