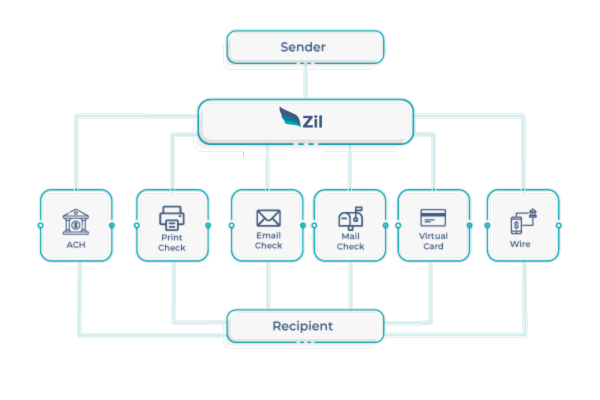

Send Money conveniently with Zil.US. You can send Money to your payees via ACH, Wire Transfer, or any other payment method that suits your needs. It is easy for businesses to conduct transactions with Zil.US, the cloud-based platform, since it offers the perfect platform for making transactions. Zil.US allows businesses various options for paying their payees, including cards, eChecks, ACH, and wire transfers. Read this article to know more about sending money.

Various Payment Methods

There are different payment methods to send and receive Money, including ACH, Wire transfer, eChecks, Mail Checks, and Cards.

Automated Clearing House (ACH): An ACH transfer or Direct Deposit is an electronic payment conducted through the ACH network in the United States. A centralized system transfers funds from one bank to another to ensure the funds are directed to their intended destination. NACHA (National Automated Clearing House Association) is the organization responsible for monitoring and controlling ACH transfers.

Zil.US’s online payment offers recurring ACH support so you can pay your payees regularly or collect payments from clients before their due dates. The Same-Day-ACH offering by Zil.US helps you transfer Money on the same day with lower transaction fees. ACH processing is now much more cost-effective.

Wire transfer: A wire transfer is a method of sending Money electronically between two or more people or between two or more businesses, in which no actual money is exchanged between the recipients. The wire transfer can be initiated in person at your or online from your checking account if you provide the recipient’s name, your account number, and the amount to be sent. Zil.US facilitates the transfer of funds online using wire transfers, a faster, more convenient way to send and receive wire transfers online.

Expense card: With a card, you use your checking account to pay for your purchase. A card is a form of digital Money. It can be used to make purchases when you don’t have liquid cash. You usually receive a Card from your bank when you open a Savings Account. Expense card transactions are reflected in your account statement so that you can keep track of your expenses and transactions.

The card has a 16-digit number known as the Card Number, an Expiry date in front, and a 3-digit CVV number at the back. Businesses can send Money to cards instantly through Zil.US. Log in to your Zil.US account and select a business checking account. Click on the Send Payment button and select the card option. Select a payee from the contact list, add the amount, and click Send. Zil.US cards can also be used to make credit payments.

eCheck: eCheck is a digital form of a paper check and is also known as an electronic check, online check, internet check, and direct debit. Customers send you funds electronically so you can receive them at a lower cost. It is also safer, faster, and reliable.

Mail Check: Mailed Checks are checks sent and received through the mail. Fill it out properly and put it in an envelope before mailing it. Get a tracking number so you can track the progress of the check.

Things to Keep in Mind While Making International Payments

There are certain things to keep in mind while making international payments. High commission fees, slow process and no guarantee, unfair exchange rates during a money transfer, and bothering documentation to send money.

Excessive commissions fees: Sending money overseas with a bank or western union will charge you high commission fees. This will make the vendors or businesses pay a large portion of their profit.

Conclusion

There are several ways to send money. Zil.US offers a convenient platform for businesses to conduct transactions, with various payment methods available. With Zil.US, you can choose the payment method that best suits your needs without any worries.