Business Bank Accounts must have a reliable and efficient banking system to manage your finances effectively. In today’s digital age, online banking platforms have become an increasingly popular choice for businesses of all sizes. One such platform is Zil.US, which offers cloud-based online business account services to meet the needs of start-ups and small businesses. The business bank account have no minimum balance requirements and no monthly maintenance fees.

Features of Zil.US

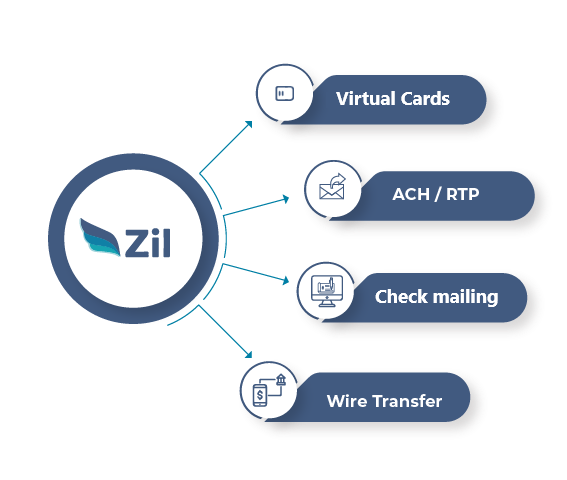

Zil.US offers a comprehensive range of features to meet the business banking needs of start-ups and small businesses. Here are some of the key elements of the platform business bank account services:

1. Cloud-Based Online Payment Platform: Zil.US online payment platform is cloud-based, making it accessible to businesses of all sizes. This platform allows you to manage your finances anytime, anywhere, and from any device. You can easily view your account balances and transaction history and quickly pay vendors and suppliers.

2. No Monthly Fees or Minimum Balance Requirements: Zil.US business account services are free to open, with no monthly fees or minimum balance requirements. This is particularly beneficial for start-ups that are just starting and need to keep their expenses low.

3. ACH and International Wire Transfers: Zil.US offers its users ACH and International Wire transfers at a lower cost than other banks. You can save money when sending or receiving payments from domestic and international clients. With the platform, they can transfer funds quickly and securely without worrying about high fees or complicated processes.

4. Business Card: Zil.US provides customers with a business card to purchase or withdraw cash from ATMs. The card is linked directly to your business bank account so that you can track your expenses in real time. With a business card, you can manage your cash flow more efficiently, and you won’t have to worry about carrying large amounts of cash around.

5. Dedicated Customer Support: The platform has dedicated customer support with business account services. You can contact Zil.US’s customer support team via phone, email, or chat if you have questions or concerns about your account. The team is available 24/7 to help you with any issues or inquiries.

6. Cost-Saving Advantages: Zil.US offers cost-saving advantages to start-ups and small businesses with business account services. With no monthly fees or minimum balance requirements, ACH and International Wire transfer services at a lower cost, and a business card that allows you to track your expenses, Zil.US helps you save money while efficiently managing your finances.

Conclusion

In conclusion, Zil.US business checking account offers a comprehensive range of features to meet the needs of start-ups and small businesses. With its cloud-based online payment platform, free account opening, and no monthly fees or minimum balance requirements, the platform provides a cost-effective solution for managing your business finances. Additionally, the platform offer ACH and International Wire transfer services at a lower cost, the provision of a business card, and dedicated customer support make it a comprehensive option for all your business banking needs.