ACH Payments

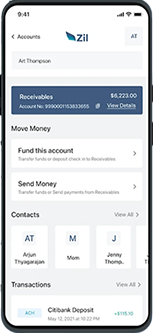

ACH Payments enable electronic transfers between financial institutions via the Automated Clearing House network. Seamless online transactions from any location are made possible with ACH payment processing, using computers, tablets, or mobile phones. With Zil.US you can make one-time or recurring ACH payment cost effectively. The platform’s same-day ACH feature provides customers with access to their funds within just one business day.

Zil US powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

ACH Payment Meaning

Automated Clearing House is a network for electronic funds transactions between U.S. accounts. It will let you send ACH payments online between your account and a vendor or employee account. It’s also easy to make ACH payment online for your small business. Zil.US offers a user-friendly and efficient solution for making ACH payments, all at a cost-effective rate.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

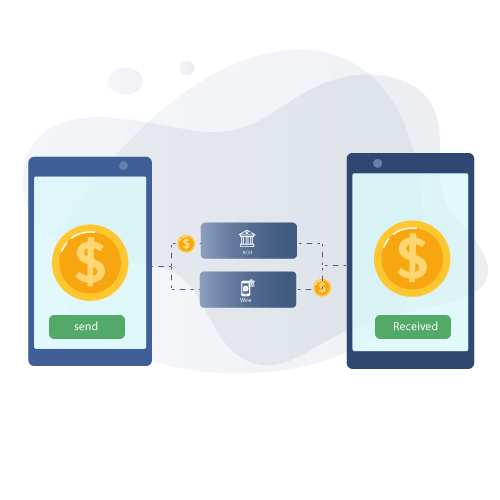

ACH Payment and Wire Transfer

ACH is more suitable for recurring transactions with lower amounts. In contrast, wire transfer is preferred for urgent, high-value domestic and international transactions. Codes like SWIFT or IBAN are needed for international wire transfers, while domestic wire transfers require routing and account numbers. Zil.US ensures secure transactions for both types of transfers.

Easy to Access

High Security

Easy Payment

Advantages of ACH Payment

ACH (Automated Clearing House) is a digital payment system operating within the United States, enabling easy fund transfers between accounts. It shows swiftness, efficiency, and cost-effectiveness, with lower fees than alternative methods. Zil.US has powerful encryption measures to safeguard your personal information, ensuring safety, security, and convenience for automated payments. ACH payments are widely embraced and closely monitored by NACHA to guarantee seamless operations. Typically, ACH payments take 1-2 business days to process, but the platform’s same-day ACH processing happens in 24 hours.

FREQUENTLY ASKED QUESTIONS

What is needed for ACH payment?

To make an ACH payment provide necessary details like valid routing and account number, account type (checking or saving) and amount to be transferred.

What is ACH payment?

The ACH network is a computerized system that manages and processes transactions between banks and financial institutions. Open a business checking account with Zil.US and effortlessly make ACH transfer.

Are ACH payments safe?

ACH payments are a secure way to transfer funds due to strict regulations enforced by clearinghouses. Money moves directly between accounts, keeping account numbers confidential. Zil.US enhances security with advanced features, providing a safe environment for ACH transactions.

ACH Payment vs Wire Transfer

ACH is typically used for smaller, recurring transactions, whereas wire transfers are usually reserved for larger, one-time payments. Zil.US supports both ACH as well as wire transfers.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.