Novo Alternative

Novo Alternative is the best payment tool for businesses looking to enhance financial operations. Open a free online checking account to manage accounts payable effectively. Pay vendors and bills via ACH, wire transfer or check mail while eliminating monthly fees and hidden charges. Also, enjoy a digital wallet for secure transactions.

Zil US powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

We are not associated with Novo Bank. All mentions are for informational purposes only.

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

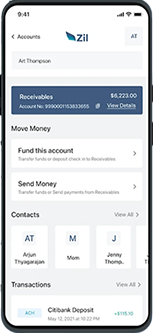

Fee-Free Checking Account

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

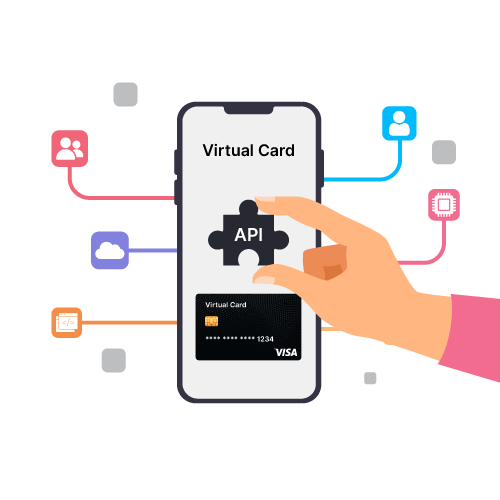

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

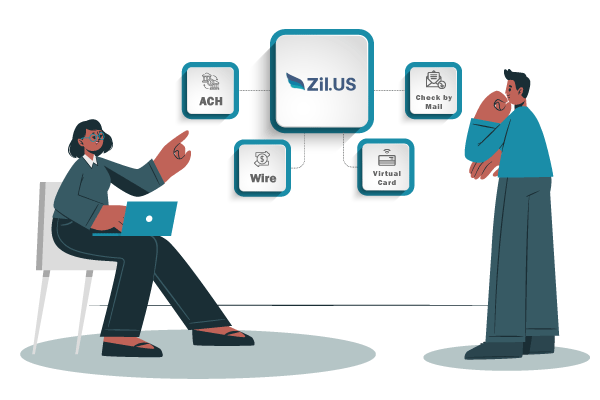

All-In-One Platform

Handle all domestic and international payments from a single platform. Zil.US offers multiple payment options to small businesses including ACH, wire transfer, check mail and more. Complete urgent transactions with domestic or international wire based on your business needs. Manage payments efficiently and securely, all in one place.

Virtual Card API

Virtual Card API from Zil.US can be integrated with your payment software for added convenience. This allows users to create virtual cards with spending limits in a few clicks. Businesses can now manage finances easily while maintaining control over expenses. Also reduce the risk of fraud by using unique virtual card numbers for transactions.

Easy to Access

High Security

Easy Payment

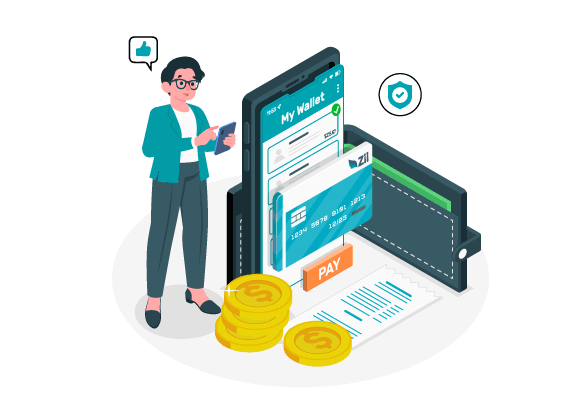

Digital Wallet

Make payments from a digital wallet via ACH and domestic wire with ease. Enjoy the benefits of fast, reliable payments without the need for physical cards. With the digital wallet, businesses can access and control their funds on the go. Fund your wallet from any account and review transaction details instantly. Users can have full control over business finances by using Zil.US.

FREQUENTLY ASKED QUESTIONS

Which checking account is best?

The checking account offered by Zil.US is best for businesses looking to save money. It is fee-free and users don’t have to worry about initial deposits or minimum balance requirements.

Where to open checking account?

Open a free checking account online with Zil.US. Just Sign Up with the platform, complete verification after providing some basic data and you are all set to go.

Can I open checking account online?

Yes, you can open an online checking account easily with Zil.US. The platform supports multiple payment options like ACH and wire at affordable costs. You can also create virtual cards and use the digital wallet feature.

Checking Account vs Savings Account

A regular business checking account is used for daily expenses and payments while a savings account is used for setting aside funds that aren’t needed immediately. Zil.US allows businesses to open a free checking account to manage funds without hassle.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.