Business Checking Account

Business Checking Account can be opened with no monthly fees, minimum balance requirements, maintenance fees, or any hidden fees. With this cloud-based payment platform, businesses can make ACH and wire transfers at affordable rates. Open a business checking account online and enjoy fee-free business payment processing.

Zil US powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Open Fee-Free Checking Account with Zil.US

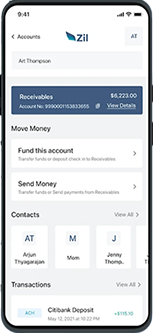

Use Zil.US to easily create multiple checking accounts and efficiently manage your finances in one place. Open several checking accounts with no minimum balance and no hidden fees. The platform assists you in seamlessly organizing and monitoring all your payments documents.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

Open a US Checking Account Anywhere in the World

Open a US checking account remotely to boost your business growth in the US. With a US account number, you can receive US dollars without exchange rate losses, saving you from costly foreign exchange fees. Also, having a US checking account gives you access to a wider range of resources. US checking is globally renowned, offering access to a worldwide market. You can trust that your account is secure, as US checking uses top security measures to protect all accounts.

Online Checking Account

Zil.US benefits both individuals and businesses. It offers 24/7 access to accounts and transactions from anywhere with the internet, saving time by eliminating the need for physical bank visits. The platform enables efficient fund transfers, bill payments, and easy access to account statements for effective financial management. With advanced security measures like two-factor authentication and encryption, online Checking Account ensures the safety of sensitive information and financial assets.

All In One Platform

Zil.US offers various payment services, such as ACH payments, wire transfers, and traditional mail checks. It is a complete solution for different payment requirements, helping organizations manage their financial transactions efficiently.

FREQUENTLY ASKED QUESTIONS

How to open business checking account?

Opening a business checking account online with Zil.US is simple. Provide your business and personal information, upload necessary documents, such as business papers and a government ID, and wait for verification.

Which business checking account is best?

Zil.US provides a free checking account with no monthly fees and a minimum balance requirement. The platform offers instant money transfers between Zil.US accounts and affordable payment methods like ACH, Wire, check mail, virtual cards, etc.

How many business checking account can you have?

With Zil.US, you can open multiple business checking account without being restricted to just one account.

Business Account vs Personal Account

Using a personal account, you would pay bills, make purchases with a card, write checks, and manage your expenses and income. But with a business account, you accept payments for your business and pay your vendors and business expenses. Opening a business checking account with Zil.US allows users to track all their business transactions.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.