Customizable Card

Customizable Card offered by the cloud-based platform allow users to personalize cards to meet specific business or personal needs. This is a great feature for expense management and letting employees access funds. With the corporate expense card, business owners can control employee cost management and track where the money is spent. The customizable cards are a helpful feature for small businesses that need to manage their expenses better. Business owners can set a budget and even recharge the card when required. Empower your expense management with customized solutions—simplify, control, and optimize your spending today!

Zil.US is a financial technology company, not a bank. Zil.US offers banking services through partnership with FDIC member banks Texas National Bank. Customers are not directly insured by the FDIC - but through the pass-through coverage of our partner banks and is conditional on proper titling, record-keeping, and custodial arrangements.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Simple and Convenient Payment Solution for Business

Zil.US’s customizable corporate expense cards provide convenient access to your checking account funds and allow you to purchase globally wherever Visa gift cards are accepted. Whether shopping online or in person, you can use your Zil.US card to make payments hassle-free.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

Benefits of Customizable Cards

Customizable cards benefit small businesses by enabling better control over employee expenses. They allow you to establish spending limits and specify which types of merchants the card can be utilized at. Additionally, you can temporarily freeze or permanently cancel the card via your mobile payment app in case of loss or theft.

You Can Get Multiple Cards

You can easily obtain several virtual cards for your business using just one account. These cards can be assigned to multiple employees with specific spending limits, allowing you to maintain strict control over your budget for business expenses. Additionally, it provides clarity to team members regarding available funds for spending.

Easy to Access

High Security

Easy Payment

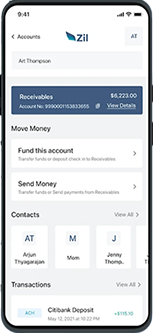

Checking Account

Zil.US provides a comprehensive checking account to simplify money management for individuals and businesses. With the fee-free checking account and no minimum balance requirements, you can easily handle your finances without worrying about hidden charges. Online payment solution makes managing your funds and making payments from any location effortless. Zil.US prioritizes the security of user data and transactions. This payment option offers the freedom and convenience to simplify financial affairs for people and businesses.

FREQUENTLY ASKED QUESTIONS

How to customize credit card?

You can easily customize your credit card with Zil.US. This enables small businesses to have better control over their employee expenses. Also, you can set spending limits, temporarily freeze a card, or permanently cancel them.

How to get a customized card?

With Zil.US, you can effortlessly customize your card. The platform provides customizable corporate expense cards for small businesses to manage employee expenses effectively.

Can I customize my card?

With Zil.US, yes! You can customize your card and can obtain several virtual cards for your business using just one account with Zil.US. The platform’s customizable corporate expense cards let you use Visa cards worldwide. You can access your checking account funds effortlessly with the platform’s customizable cards.

Credit Card vs Expense Card

Credit cards let you borrow money up to a set limit for purchases and require a return, frequently with interest, by the due date. However, cards pull funds directly from your checking account, restricting spending to the balance and avoiding interest. With Zil.US, you can easily customize and create your virtual credit and card.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.