Expense cards offer many people the convenience of credit cards and the immediacy of cash.

Stopping further debt accumulation is an important step toward financial stability. A card for everyday purchases is a great way to accomplish this. Expense cards eliminate the need to carry cash or physical checks. Open a business bank account at Zil.US without hidden maintenance fees or minimum balance requirements. Open and get the best card for your business purpose.

What Is a Card?

The money is taken directly from your checking account when you use a card. They are also called “check cards” or “bank cards,” You can use them to buy goods or services or get cash from an ATM or a store that lets you add more money to a purchase.

Advantages:

- More secure than cash.

- It does not incur debt.

- Simple to obtain—no application required.

- Much easier to carry than cash.

- Accepted around the world.

Disadvantages:

- Spending is limited to cash in the bank and/or a daily amount.

- Overdraft fees are easily incurred.

- Fewer benefits and safeguards than credit cards.

Contactless Technology

More and more cards have contactless technology, meaning you don’t have to enter your PIN to make a purchase.

For contactless machines to work with your card, it needs to have a chip. If you don’t have one, you can ask your bank if they can give you one.

You can put a contactless card into a machine when you use it. You can hold it or tap it over the top instead. Most of the time, the machine will beep and show that the transaction has been approved.

You must be careful where you put a contactless card because cards have been read by mistake.

Difference Between Credit and Card

People often mix up cards and credit cards, but they are different and have different pros and cons.

Expense cards are the way to go when it comes to debt reduction. A debit means no depth or no bill.

Purchases made with a card are limited to the amount of money in your checking account. The money is taken straight out of your account when you buy something or soon after, so you don’t have any debt.

Credit means depth or monthly bill, and credit cards provide credit and allow you to spend more than your checking account balance.

While credit card purchases have the potential to help build credit if the card balance or amounts due are paid on time (a huge plus! ), they also create debt.

The bank pays for your purchases in advance when you use a credit card. You agreed to pay the amounts back by a specific date, your credit card monthly bill due date, per your contract with your bank. Otherwise, the bank will assess interest and late fees.

However, credit card use becomes risky when cardholders cannot pay credit card bills as they become due. You will be required to pay interest and fees in addition to any previously unpaid interest and fees and your original bill balances.

What Is a Virtual Card?

They are credit or cards that operate entirely online. These virtual credit or cards work like physical credit or cards but are completely virtual. They have 16-digit numbers that are generated randomly, including a card verification number and an expiration date. The primary distinction between physical and virtual cards is their ease of use. Virtual payment cards make it easier to pay vendors and suppliers, which is good for your business in many ways.

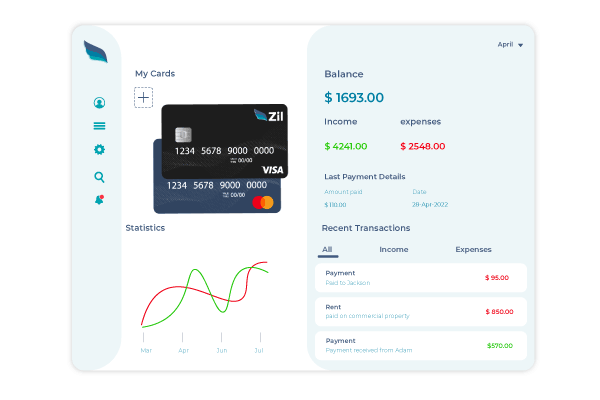

Benefits of Card Features in Zil.US

Zil.US’s physical card can be used to pay for things anywhere that take cards, and they also can cash out from ATMs without any ATM fees. If you make several payments daily for your business, a Zil.US Visa card is a useful tool.

Our platform also provides a virtual card that can be used in different places. Customers can apply for virtual cards, so they can pay for things in stores without touching a card reader, it is safe and easy.

Expense cards can make your life much easier, and they’re the obvious solution if you don’t want to borrow money. If you’re looking for the best cards for your business, our online platform Zil.US gives one of the best card for you. Open multiple checking accounts and get virtual and physical card from Zil.US.