Home Bank Alternative

Home Bank Alternative Zil.US helps businesses manage their finances without any hassle. Users can open a US payment account remotely and enjoy a fee-free checking account. You can pay and get paid via ACH, check mail, and wire transfer.

Zil US powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

We are not associated with Home Bank. All mentions are for informational purposes only.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Fee-Free Checking Account

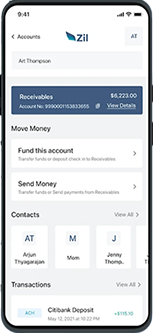

Having a checking account is crucial for your business to handle frequent transactions. With Zil.US, you get a checking account tailored to small business needs without minimum deposit or monthly maintenance fees. Enjoy hassle-free and swift money transfers, including same-day ACH and wire transfers. Users can access their accounts anytime, anywhere, through the mobile payment platform.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

Corporate Expense Card

The Corporate Expense Card from the cloud-based payment platform is an excellent tool for managing expenses and granting employees access to funds. With these cards, business owners can oversee employee spending and monitor where funds are used. These customizable cards are beneficial for small businesses seeking better expense management. Owners can establish budgets and reload the card as needed.

Cloud Payment Solution

Cloud payment solution services manage payment operations, and store data and applications rather than using local servers or data centers. These companies enable banks to offer various financial services online, enhancing security, cutting costs, and speeding up the rollout of new services. Cloud-based platform helps banks adapt to evolving customer needs and remain competitive in the digital era. This platform provides cost-effective payment services at affordable rates, including fee-free checking accounts, same-day ACH, wire transfers, mail checks, and more.

All-In-One Platform

Zil.US offers a comprehensive solution for all your business requirements. The platform includes virtual cards, ACH, wire transfers, physical cards, mail checks, multi-business accounts, early payment options, payment solution for non-US residents, and more.

FREQUENTLY ASKED QUESTIONS

Which is the best alternative for Home Bank?

Zil.US is the best alternative to Home Bank, offering convenient 24/7 online access and the option to open a checking account with zero minimum deposit or hidden fees.

How long will it take to open an online business checking account?

You can open a business account with Zil.US in just 48 hours. No fees, no minimum balance, and no hidden fees.

How to open a business bank account?

Open a small business account with Zil.US, free from hidden fees. Apply directly from your device and experience the top payment solution solution for freelancers, start-ups, and modern businesses.

Checking Account vs Savings Account

A checking account is for daily transactions, offering features like card access and check-writing for easy withdrawals and payments. A savings account is for saving and growing funds, often earning interest, with fewer transactions allowed, making it ideal for long-term savings and emergencies.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.