In today’s fast-paced business landscape, where seamless financial transactions are paramount, having a reliable online checking account is essential. That’s where Zil.US comes into the picture. As a leading provider of innovative banking solutions, the platform offers businesses an exceptional online checking account that revolutionizes how they manage their finances. One key aspect that sets the software apart is the unique checking account number associated with each account, ensuring secure and accurate transactions.

With the platform’s online checking account, entrepreneurs can streamline their cash flow, conduct ACH transfers, and seamlessly handle international wire transfers. Moreover, Zil.US’s commitment to affordability is evident through its no account fees or minimum balance requirement policy, enabling businesses to allocate their resources wisely.

Empowering Business Transactions

The platform’s online checking account redefines the way businesses handle transactions. It provides an effortless platform for managing finances, allowing entrepreneurs to streamline and organize their cash flow seamlessly. Whether conducting ACH transfers or international wire transfers, Zil.US covers all bases.

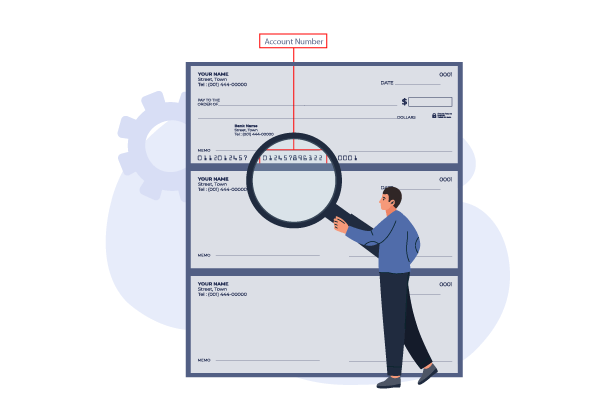

In addition, the checking account number associated with your cloud-based banking platform account acts as a secure identifier for each transaction, ensuring accuracy and accountability. By offering these essential services, the platform ensures businesses can efficiently send and receive funds domestically and internationally, facilitating global operations.

Unparalleled Affordability for Businesses

Affordability is paramount for businesses, particularly startups and small enterprises. Zil.US stands apart from the crowd with its incredibly cost-effective business checking account. Unlike traditional banks burdened with excessive fees, the platform offers an account with zero or minimum balance requirements. This liberates businesses from unnecessary expenses, allowing them to allocate resources toward growth.

The checking account number associated with the software account ensures that your financial transactions are conducted securely and efficiently, providing peace of mind for businesses. The platform lets you access essential banking services without financial strain, maximizing your profits and enabling you to invest in your business’s success.

Seamless Account Opening Experience

Opening a business checking account should be seamless, and Zil.US ensures just that. Opening an account with the platform is a hassle-free experience effortlessly executed online from the comfort of your office or home. This eliminates time-consuming visits to a physical bank branch, saving time and effort. Moreover, the account opening process with the software is free of charge, allowing you to get started without any upfront costs.

The checking account number associated with your B2B platform account is provided upon successful account opening, ensuring a secure and personalized banking experience. The platform prioritizes convenience and accessibility, making it ideal for busy entrepreneurs seeking a smooth and effortless banking experience.

Conclusion

Zil.US’s business checking account, with its robust features and exceptional affordability, emerges as the ultimate solution for businesses needing seamless financial management. The checking account number associated with your platform account ensures secure and accurate transactions, providing peace of mind. By offering a hassle-free account opening experience, the banking platform demonstrates its commitment to convenience and accessibility for busy entrepreneurs. With no account fees or minimum balance requirements, the software empowers businesses to save on banking expenses, enabling them to invest in their growth.

Trustworthy and reliable, Zil.US’s online checking account paves the way for businesses to efficiently manage their finances and thrive in today’s competitive landscape. Experience the difference between the platform and unlock your business potential today.