Wire transfers have long been a staple in modern banking, enabling the swift and secure transfer of funds across financial institutions. The online banking platform of Zil.US, which offers immediate wire transfers with low transaction fees, significantly transforms this process. The platform guarantees efficient processing of both domestic and international transactions, enabling users to comfortably transfer payments. Logging into the cloud-based platform opens a world of instant wire transfers online, allowing users to send and receive funds via computers, tablets, or smartphones.

Introducing the All-In-One Banking Platform

Zil.US presents itself as an inclusive financial solution designed to improve the banking processes for small businesses, freelancers, and startups. The cloud-based banking platform makes it simple to establish a business account in the United States; there are no monthly fees or minimum balance requirements. The platform enables transactions via an assortment of channels, including wire transfers, printable checks, e-checks, and ACH, which are just a few of its standout features.

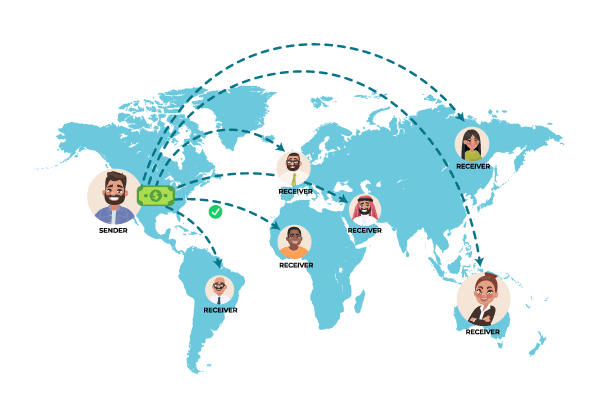

Swift and Secure International Money Transfers

The platform’s wire transfer service prioritizes security, speed, and reliability in all transactions. Patrons appreciate the ease of initiating wire transfers directly from their online checking account, which guarantees an organized process that maintains strict security protocols.

Get Paid Early with New Financial Technology

One standout feature of this platform is the provision for receiving payments ahead of schedule, offering a significant advantage to individuals managing bills or unexpected expenses. Zil.US has the potential to expedite the delivery of wages to users by two days, thereby improving the ability to manage finances and plan for future requirements.

The Convenience of Instant Wire Transfers Online

Wire transfers are the go-to solution for vendor and supplier payments due to their faster processing time. The online banking platform also offers same-day wire transfers that are accessible via computers, smartphones, and tablets, which enhances this convenience. The wire transfer process is quite uncomplicated; users are required to enter the recipient information, which guarantees the speedy and effective transfer of funds.

Wire and ACH Transfers: Understanding the Difference

ACH and wire transfers are both electronic money transfer methods; however, they vary in terms of fee structures and processing durations. Although they incur higher transaction fees than ACH, wire transfers are ideal for transferring large sums of money quickly. By offering users an in-depth understanding of these alternatives, Zil.US enables them to make well-informed decisions that align with their immediate requirements.

Why choose Zil.US?

This cloud-based banking platform facilitates diverse payment methods, including check drafts, eChecks, and invoices, along with wire transfers. The platform’s user-friendly interface allows easy setup of US business accounts with zero monthly fees or minimum balance requirements. The comprehensive suite of features covers printable checks, ACH transfers, and rapid wire transactions, empowering small businesses and freelancers to manage their finances efficiently.

Zil.US stands as a testament to modern banking solutions, offering swift wire transfers, early payment options, and a user-friendly interface—making it an optimal choice for businesses and individuals looking for efficient and secure financial services.