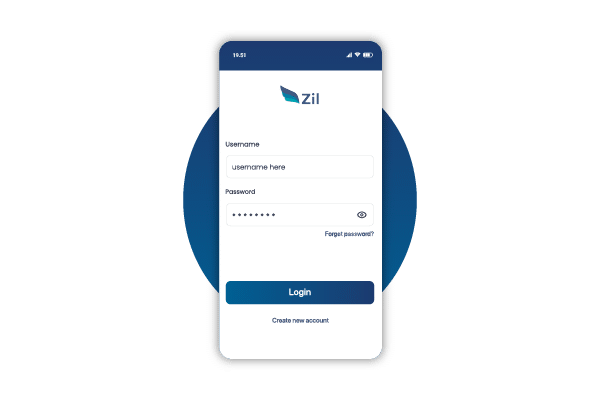

No Fee bank accounts from Zil.US with no monthly fees. Open a US bank account on Zil.US by logging in. Without any additional cost, you can access it whenever you want. Zil.US cloud-based online banking provides SMEs with a fee-free checking account that allows them to send instant payments using any method they want, including wire transfers, ACH, printable checks, eChecks, and Real-Time Payment. The checking accounts offered by Zil.US Online Banking are free. There is no first deposit cost on Zil.US to open a checking account. Transfer money instantly with ACH, checks, or wire transfers.

Open a US Business Bank Account

You should think about opening a US bank account if you want your company to grow more quickly. The ability to take US cash without incurring exchange rate loss is only one of the many advantages of having a US bank account. Additionally, you can provide your consumers with a variety of payment options without substantially reducing your market share. You can benefit from US-only advantages if you have a US bank account. Without travelling to the US, you can open a US business bank account online and take advantage of all its advantages. Therefore, opening a US bank account is the ideal course of action if you want to expand your company more quickly in the US.

By opening the best Checking accounts from anywhere, you may expand your business in the US more quickly. Without travelling to the US, you can open a US business bank account online and take advantage of US banks’ features. Because of this, accepting US cash without incurring exchange rate loss is possible when you have a US number. In order to avoid losing out on a sizable portion of the market, you may also give your consumers a variety of payment options.

Online Banking

The younger generation of today prefers to bank online, and it’s the way of the future. The fact that it is so simple and easy to use is one of the causes. The ability to do banking from the convenience of your home is the main reason why everyone chooses online banking. In the comfort of your home, you may check your balance, transfer money, and pay bills. Online bank Zil.US provides one of the best business accounts with a variety of advantages.

Why Zil.US?

With a variety of features, Zil.US allows boundless transactions and endless revenue. You can process ACH, Wire, and direct deposits through the bank. In addition, Zil.US provides a checking account with no fees. Users are immune from minimum balance requirements and monthly transactions, and the account is free.

Open Fee-Free Checking Account Today

Zil.US is a cutting-edge financial services provider that provides businesses with a variety of features and advantages. Businesses can use Zil.US to benefit from an unlimited number of transactions and earnings as well as a variety of other services like check draughts, checks by mail, eChecks, and invoices. Businesses can also design and print own checks using the company’s check printing software. Businesses can use Zil.US to maximize their financial transactions while saving time and money.