Online Checking Account Free

Online Checking Account Free can help businesses manage accounts payable and receivable transactions easily. The cloud-based platform does not charge any monthly fee or have hidden costs. Make payments quickly via affordable payment options like ACH and wire transfers. Also create virtual cards and make online purchases from a wallet to improve financial processes.

Zil.US is a financial technology company, not a bank. Zil.US offers banking services through partnership with FDIC member banks Texas National Bank. Customers are not directly insured by the FDIC - but through the pass-through coverage of our partner banks and is conditional on proper titling, record-keeping, and custodial arrangements.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Benefits of a Free Online Checking Account

A free online business checking account allows users to manage finances cost-effectively. Eliminate monthly fees, maintenance fees, and hidden charges, keeping more funds in your account. There are no minimum balance requirements – which means that businesses have more flexibility. Zil.US also allows you to open multiple accounts to separate expenses and maintain organized financial records.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

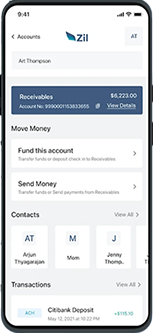

Manage Finances Anytime, Anywhere

Users can access their Zil.US checking account from anywhere on any device. The platform ensures a user-friendly experience on both Android and iOS, allowing you to make payments from anywhere. It doesn’t matter if you are in the office or on the go – you can depend on the security and reliability of Zil.US to manage accounts and track financial activity.

Virtual Cards

Virtual cards can be a useful financial tool for small businesses, offering better control and security. Create virtual cards with a few clicks with Zil.US and manage online transactions more easily. You can set spending limits on the cards and assign them to employees for better control over expenses. Also deactivate a card anytime to prevent fraud and unauthorized transactions.

Easy to Access

High Security

Easy Payment

International and Domestic Transfers

Businesses can handle both domestic and international payment needs with the cloud-based platform. You can pay vendors through ACH and domestic wire transfer for quick secure transactions. The platform also supports cross-border payments, ensuring your international transactions are processed easily. Also, make use of Zil.US wallet for added convenience.

FREQUENTLY ASKED QUESTIONS

Where to open free checking account?

You can open a free checking account with Zil.US and manage domestic and international payments easily. The platform does not have any hidden fee and supports ACH and wire transfers.

Are checking accounts free?

Not all checking accounts are free but Zil.US offers a fee-free business checking account. The platform also lets users create virtual cards and make use of a wallet for payment needs.

How to open online checking account?

You can open online checking account with Zil.US. Sign Up with the platform and complete the verification process by providing some basic details. Once verified, your account will be active, and you'll have immediate access to manage payments.

Checking Account vs Savings Account

A checking account is for regular expense management like daily transactions and bill payments while a savings account is designed for storing funds. You can open a free checking account online with Zil.US.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.