Online Checking Account

Online Checking Account is a necessity to meet all your business payment needs. The cloud-based online payment platform Zil.US provides free instant money transfers between Zil.US accounts and offers ACH and Wire transfers at a lower price. Open a business checking account with Zil.US and enjoy a fee-free business payment solution with no hidden fees.

Zil US powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

No Hidden Fees

Zil.US online checking accounts offer a fee-free experience, eliminating monthly fees and minimum balance required. Enjoy the convenience of managing finances without hidden costs. Additionally, business checking accounts require no minimum deposit, making it easier than ever to get started. Embrace hassle-free payments with Zil.US today!

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

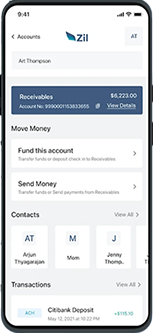

Multiple Checking Account

Businesses can efficiently manage their funds by creating multiple checking accounts with Zil.US, simplifying financial management. This platform allows you to handle personal and business expenses seamlessly, ensuring better organization of your finances. With multiple accounts, you can allocate payments for specific purposes, optimizing financial control and management. Experience enhanced financial efficiency with Zil.US today!

Secured Transactions

Make secure and quick transactions from your home with Zil.US’s advanced online payment solution. The platform’s automated processes ensure the utmost safety for all payments, utilizing state-of-the-art security features to protect your financial information. The platform allows you to manage everyday transactions and reconcile bank accounts conveniently. Integration with over 22,000 financial institutions in the US and Canada further enhances fraud prevention. Experience peace of mind and efficiency with Zil.US today!

Easy to Access

High Security

Easy Payment

Cash Flow Management

Efficient cash flow management ensures that business maintains sufficient funds to fulfill its financial responsibilities and capitalize on growth prospects. You can make financial decisions and avoid shortfalls by monitoring inflows and outflows. Zil.US empowers businesses to manage cash flow effectively.

FREQUENTLY ASKED QUESTIONS

How to open online checking account?

Businesses can open a fee-free online checking account with Zil.US, with zero maintenance charges and no minimum deposits. Users can also easily send ACH and wire transfers at an affordable cost.

Which is the best online checking account?

Zil.US provides a free checking account with no monthly account fees and minimum balance requirement. The payment solution offers free instant money transfers and low-cost ACH and wire transfers.

Check Routing and Account Number

A check routing number uniquely identifies the payment solution, while an account number identifies the individual. Zil.US offers a free checking account for instant fee-free transfers between Zil.US accounts.

Checking Accounts vs Savings Accounts

Checking accounts are designed for daily transactions with easy access to funds through ACH, cards, and online transfers. On the other hand, saving accounts typically offer higher interest rates to encourage saving and often limit how many times you can withdraw money each month.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.