Many people in the United States are afraid to open a bank account. The main reason is the fear of needing more money to open an account, maintenance fees, and other hidden and additional charges. Open the best checking account free instantly at Zil.US without any hidden or maintenance costs and any minimum balance requirement. Open an account and enjoy all the features provided by Zil.US for all your business finance needs.

What Is a Checking Account?

A deposit account held at a bank or other financial institution that grants the account holder the ability to make deposits and withdrawals is known as a checking account.

Compared to other types of accounts, such as savings or investment accounts, checking accounts are more liquid because they permit greater deposits and withdrawals. Checking accounts don’t offer their owners much interest, if any interest at all, which is the trade-off for the increased liquidity they provide.

What Is a Checking Account Used For?

Opening a checking account free is the best option for everyday transactions. You can deposit checks, withdraw cash with your card, or set up direct deposit to automatically deposit your paychecks into your account each week.

Money can be deposited in and withdrawn from a bank checking account. A checking account is useful because it lets you quickly write checks to pay for purchases. Money can be withdrawn from the account using cards or ATMs. Checking accounts typically allow for more withdrawals and deposits than other bank accounts.

The best way to organize your finances and keep track of your expenses is to open a free online checking account. Like a regular checking account, a free checking account has no fees, minimum charges, or additional costs.

Choose the Right Bank

When opening an account, it is important to choose the bank carefully. Banks with no maintenance fees might have hidden fees, so you must be extra careful in selecting a bank account. An online bank will not ask for any fees since they don’t have actual physical branches, and opening a checking account with them is less likely to involve making a deposit. The online bank doesn’t charge fees mainly because they don’t have any overhead costs. Since they don’t have to pay for things like electricity and maintenance, the money they save is given back to customers in the form of higher interest rates or lower fees.

Traditional banks can provide a wide range of financial services in addition to the comfort and accessibility of physical branches. Bank fees and minimum deposit requirements are two ways that traditional banks generate a sizable portion of their revenue. This covers their operating expenses and gives them money to lend for mortgages.

If you are looking for a checking account free without any hidden or maintenance fees, then our platform Zil.US will be perfect for you, with these benefits, there aren’t any minimum balance requirements.

Fees to Be Vary of When Using a Checking Account

- Meeting the minimum balance requirement.

- Having two or more accounts at the same bank can help avoid service charges.

- Finding a bank that won’t charge monthly fees.

- Signing up for a direct deposit.

- Utilizing the card to its full potential.

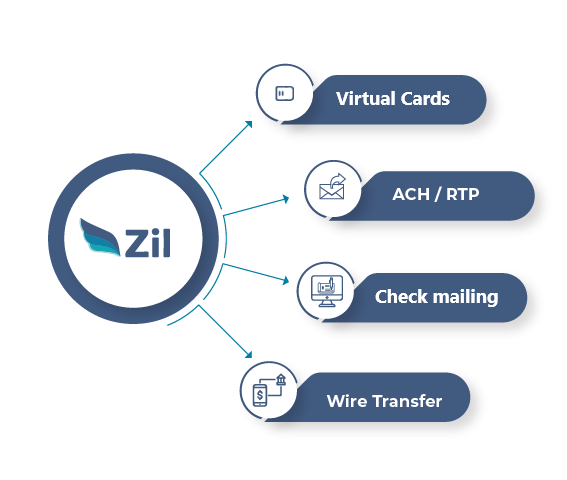

Zil.US is an online cloud-based bank that offers its customers several features and benefits. With Zil.US, businesses can benefit from unlimited transactions, earnings, and other features. Furthermore, Zil.US provides services such as check drafts, checks by mail, eChecks, and invoices. Businesses can use Zil.US’s check printing software to design and print their checks. Due to its many features and benefits, Zil.US is one of the best financial services companies in the United States.

How Many Business Checking Accounts Can You Have?

As a business owner, you have a lot of financial obligations, from inventory spending to paying taxes and employees. Managing your company’s finances is a critical responsibility. Despite how it might appear that you can only have one checking or savings account, this is not the case. It is possible to open multiple business bank accounts, which has many advantages. Having multiple bank accounts could make it easier to manage your money. You can create distinct accounts for operational expenses, taxes, and payroll. This allows you to manage your finances better and ensure that all your bills are paid on time. Having multiple bank accounts can give you more freedom.

Open multiple business checking accounts free at Zil.US without wasting your time or money.

If you are doing business, you will need a checking account to maintain your business. Zil.US provides the best checking account free, with all the required features for your business. With Zil.US, you can rest assured that there are no minimum balance requirements, maintenance fees, or hidden charges. So if you’re ready to start enjoying all the benefits of having a checking account without any headaches, Zil.US is the right choice.