We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

How Virtual Card Works?

Zil.US lets you create multiple cards in a single account, each for a different purpose. This becomes useful when you’re running a company and want to let a team member handle some spending, like marketing, but don’t want them to have access to all the company’s money or your main bank account numbers. This is where Zil.US’s virtual card feature helps. By providing a team member with a custom virtual card, they can only access the money they need for their work. It’s a safe and custom way to let team members handle company money without losing control. You can close the virtual card whenever a team member/client/purpose/project is terminated or anytime you like to withdraw that facility.

Streamlined Expense Tracking

Virtual card helps to track company expenses for budgeting and allocating funds precisely. Zil.US gives you instant information, helping you make more strategic financial decisions.

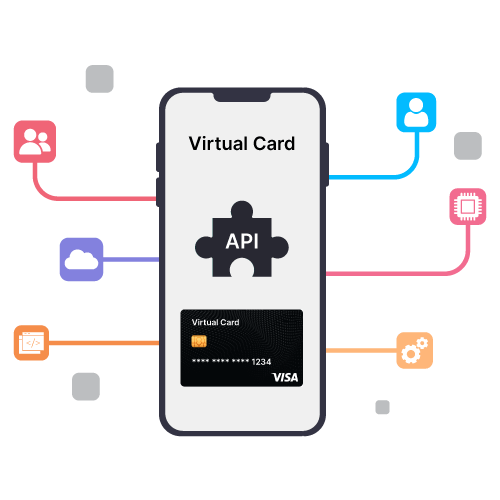

Virtual Card API

Zil.US’s virtual card API lets you use the platform’s virtual card feature in your software without login to Zil.US. The virtual card API feature lets the users enjoy the benefits Zil.US virtual card offers, like setting spending limits with interval controls for daily, weekly, and monthly use. Users can also set merchant categories for each virtual card.

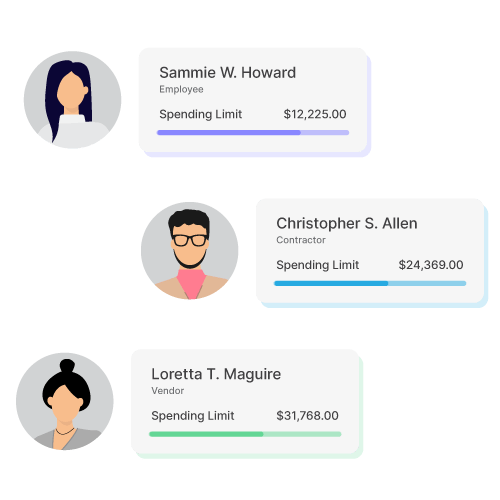

Flexible Spending Controls

Each virtual card’s spending limit can be customized, controlling how much each employee can spend. This unique feature avoids the risk of overspending in the organization. The employer can add funds, adjust your spending limit, or cancel the card anytime using the smartphone or computer.

Secure and Transparent Operations

Zil.US’s virtual card system is safe and transparent, letting you issue your cards without the headache of revealing bank account details. There are no initial fees, or hidden charges, just clear, straightforward transactions. The safety and transparency of Zil.US make it an excellent choice for businesses seeking a streamlined, secure, and efficient payment solution.

FREQUENTLY ASKED QUESTIONS

How to use virtual card?

Businesses can create virtual cards for employees to manage business expenses easily. Zil.US lets you apply for multiple virtual cards for your business on a single account with specific spending limits.

How to create virtual card?

Creating a virtual card with Zil.US is effortless all you need is to log in to the Zil.US account and select a bank account. Select Manage My Cards and click +Add. Select Virtual Card, fill in Card Details including card label, spending limit, and time span and click Next. Fill in the Billing Address and click Submit. Your new card will be ready shortly, offering a convenient way to manage expenses securely. The age limit to get a virtual card is 18.

Can you use virtual card in store?

Yes, a virtual card can make contactless online payments in-store. Sign up with Zil.US and enjoy the seamless experience.

Virtual Card vs Physical Cards

Virtual card can be used for online purchases, subscription management, and one-time purchases. They have all the properties of a physical card, including 16-digit numbers, a CVC, and a Pin Code. At the same time, physical cards are regular plastic cards primarily used for in-person payments.

CLIENT TESTIMONIALS

Success Stories from Satisfied Zil.US Clients

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.