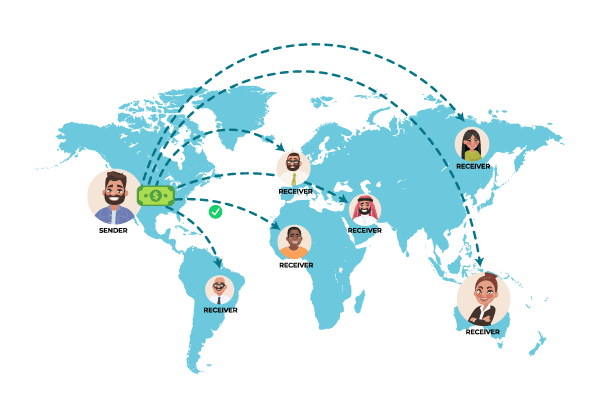

International wire transfers are a quick and convenient way to send money abroad. They offer a secure and reliable way to move funds from one country to another while guaranteeing their safe arrival. In today’s digital world, international wire transfers have become even easier. Use Zil.US to send money using wire transfer internationally. To know more about wire transfers, keep reading.

SWIFT

SWIFT helps banks talk to each other quickly and securely. Today, SWIFT is a way for more than 10,000 financial institutions in more than 200 countries to talk to each other. SWIFT lets one bank to tell another bank how to send money.

The BIC code is used to find the right bank when making international payments. When a bank wants to join the SWIFT network, the SWIFT organization gives the bank a code.

What Is a Wire Transfer?

Wire transfers are when you electronically transfer money to someone else. This is done through a network that is run by banks and other transfer services all over the world. When you do a wire transfer, you need information from the person you’re sending the money to, like their name and account number. Wire transfers don’t involve physically giving someone cash, but they are settled electronically.

Types of Wire Transfers

Domestic Wire Transfers: A domestic wire transfer is a payment between two banks or institutions within the same country.

- Intra-bank Electronic Fund Transfers

The sender and the recipient have to be the customers of the same bank. The software at the bank is instructed to transfer funds between accounts or branches. Simply put, money is transferred from one account to another.

- Inter-bank Wire Transfers

The sender and recipient of the transfer are from different financial institutions. Banks participate in a secure, closed network that collects and settles intra-bank wire transfers. Money is transferred from the sender’s bank account to the recipient’s.

International Wire Transfers: International wire transfers are payments sent from one country to another. The sender must start the payment, even if the person they’re sending money to also has an account at the same bank. You need a routing code to make a wire transfer internationally.

- Intra-bank

Some large banks have branches in multiple countries, while others have their accounts in foreign banks.

Banks typically use the SWIFT network for these transactions. This means that transfers can be sent without using an intermediary bank.

- Inter-bank

Not all banks have accounts in foreign banks. This is where an intermediary bank comes into play. It serves as a rest stop for the payment as it travels to its final destination.

When this occurs, the payment must comply with regulations in the sender, intermediary bank, and recipient countries. Because of these additional requirements, the process may take slightly longer than with other wire transfer services.

Is Wire Transfer Safe

A government agency in the United States called the Office of Foreign Assets Control keeps an eye on international wire transfers. This agency ensures that no funds are sent to terrorist organizations or countries that the US has sanctioned. This agency also makes certain that no money is laundered through these transfers.

International Wire Transfer with Zil.US

International wire transfers are now simple thanks to Zil.US, a cloud-based banking platform. Businesses can use Zil.US to securely transfer funds to anyone outside the country for a low transaction fees. Zil.US makes it simple to send money for a purchase, pay a bill, or transfer funds. International wire transfers processed by Zil.US will take 1–5 business days.

To move money quickly, you can use the web or our app. The app has all of the features of our web app, so you can do business while you’re out and about.

How to Do Wire Transfer Internationally with Zil.US?

Zil.US allows businesses to make international wire transfers securely. They can do this by logging in, choosing a business bank account, selecting the wire transfer option, and proceeding to payment.

- Step 1: Log in to Zil.US and choose a business bank account,

- Step 2: Click on the Send Payment button. A drop-down menu will appear. From there, select the Wire transfer option from the menu.

- Step 3: Select the International wire transfer option and choose a payee. Enter the amount you want to transfer and the necessary details. Click send, and you will receive an OTP through email or SMS.

International wire transfer will start after you enter the OTP and is often processed within 1 to 5 business days.

International wire transfers are a convenient and efficient way to move money worldwide. With the right service provider, it’s easy to set up safe payments via wire transfer internationally that cost as little as possible and arrive quickly and safely. If you are looking for the right services, look no further than Zil.US, open multiple business accounts in Zil.US without any hidden or maintenance fees or minimum balance requirements.