ACH

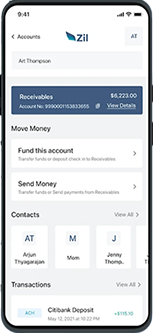

ACH (Automated Clearing House) is the U.S. financial network used for electronic payments and money transfers. You can experience quick payments on Zil.US, an official member of NACHA, which regulates ACH payments. With the recurring ACH facility, you can make regular direct deposits to your payees or collect direct payments from clients before due dates.

Also, pay and get paid by wire transfers anytime, anywhere through computers, tablets, or smartphones.

Zil US powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

What is ACH?

ACH stands for Automated Clearing House. It is a U.S. financial network that helps people to make electronic payments and money transfers. ACH transfers money from one bank to another over a secure network run by NACHA. When you use Zil.US, you can experience faster processing and other benefits for your business checking account.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

NACHA Membership

ACH payment processing, called direct payments, allows for electronic bill settlement. It lets funds move securely from your checking or savings account to another bank digitally. NACHA oversees these transfers, ensuring a regulated and secure process.

Advantages of ACH Payment

Automated Clearing House is a digital payment system in the US that simplifies fund transfers between bank accounts, making them easy, fast, and affordable. Zil.US prioritizes safety with firm encryption for your personal data, providing secure and convenient automated payments. NACHA closely monitors payment for smooth operations. While payments typically take 1-2 days, Zil.US offers same-day processing on the same business day.

Easy to Access

High Security

Easy Payment

All-In-One Platform

Zil.US offers cloud-based payment services tailored for businesses. You can easily open a fee-free checking account with no minimum balance needed. The platform also efficiently handles employee expenses with customizable corporate expense cards. Zil.US supports various payment methods, including mail checks, wire transfers, and virtual cards.

FREQUENTLY ASKED QUESTIONS

What is ACH?

ACH stands for Automated Clearing House, the U.S. financial network managed by NACHA for electronic payments and transfers. With Zil.US, you can enjoy faster payment processing and other perks for your business checking account.

What is ACH transfer?

ACH transfers in the United States are electronic bank-to-bank payments facilitated by the ACH network (Automated Clearing House). This system, managed by the National Automated Clearing House Association (NACHA), efficiently directs funds from one bank to another. Utilize the Zil.US feature to effortlessly manage regular payments to your payees or collect payments from clients hassle-free.

How long does ACH transfer take?

An ACH transfer is typically delivered and settled in a few business days. Zil.US, an official member of NACHA, offers customers same-business-day ACH transactions on its platform.

ACH vs Wire

The main difference between ACH and wire transfer is that wire transfers can only push money, while ACH is used to both push and pull money. It typically takes longer to credit than a wire transfer, which transfers bigger sums of money. Wire transfers have a higher transaction fee percentage than ACH. With Zil.US, businesses can make transactions through ACH and wire at affordable costs.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.