Best Checking Account

Best Checking Account offered by the all-in-one platform have no hidden fees or minimum balance requirements, making them perfect for small businesses. This cloud-based platform lets you create a fee-free business checking account and manage your payment needs from your office. Businesses can easily access and expand their funds without minimum balance, deposit requirements, or monthly fees.

Opening a business account with Zil.US can help SMEs to meet all their business needs in a single platform. You can send money through ACH and Wire transfers, Checks by mail and more.

Zil.US is a financial technology company, not a bank. Zil.US offers banking services through partnership with FDIC member banks Texas National Bank. Customers are not directly insured by the FDIC - but through the pass-through coverage of our partner banks and is conditional on proper titling, record-keeping, and custodial arrangements.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

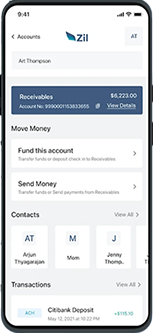

Multiple Checking Account

Creating a separate business account is essential for small business owners. It provides legal protection, separates personal and business expenses, and improves financial management. Keeping business funds separate helps track transactions, boosts credibility, and makes accessing loans and credit cards easier. With Zil.US, you can create multiple checking accounts for different needs.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

Business Expense Card

Zil.US’s corporate expense card streamlines expense tracking and improves spending control. Businesses may distribute payments to staff, track costs in real-time, and establish spending limitations for categories or people with the Zil.US business expense card. The card may be used for business travel, entertainment, and supplies, making it a versatile tool for financial management. Businesses may improve spending awareness and make choices with immediate alerts and thorough cost reports. The Zil.US business expense card promotes responsible spending and simplicity, helping firms reduce expenditures and enhance financial management.

Instant Business Payment

Zil.US transforms business finance with instant transfers between Zil.US accounts. Enjoy free online account creation, effortless access to affordable payment services, and seamless management of supplier payments, client transactions, and everyday expenses. Open a Zil.US account online with complete transparency and no hidden charges.

Easy to Access

High Security

Easy Payment

All-In-One Platform

Experience the ultimate in-business payment with the best online checking account from Zil.US. This cloud-based service offers a comprehensive solution for all your business needs. With the all-in-one platform, you can effortlessly make transactions through ACH, wire transfers, and virtual cards, simplifying your financial management.

FREQUENTLY ASKED QUESTIONS

Can I open a checking account online?

Yes, you can open a checking account online through Zil.US easily and efficiently without any maintenance fees or hidden fees.

How to open a business account?

You can easily open a business checking account online through Zil.US, with no maintenance fees or hidden charges. Enjoy a seamless experience and manage your finances with ease.

What do you need to open a checking account?

To open a checking account, you'll typically need to provide identification, such as a driver's license or passport, along with your Social Security number. Additionally, you may need to provide proof of address and an initial deposit. With Zil.US, you can easily open a business checking account online without maintenance fees or hidden charges.

Business Account vs Personal Account

A business account is designed to manage company finances and often requires additional documentation such as an EIN and business registration. On the other hand, personal accounts are intended for individual use and typically require personal identification and proof of address for opening.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.