ACH vs Wire Transfer

Zil US powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Automated Clearing House

ACH (Automated Clearing House) is the U.S. financial network for electronic payments and transfers. Zil.US, a NACHA member, offers fast ACH payments, including recurring and same-day ACH. Recurring ACH can be used for regular direct deposits or client payments ahead of schedule. The same business day is faster transactions that allow money to be sent to the receiver on the same day.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

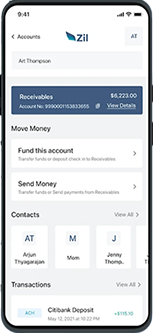

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

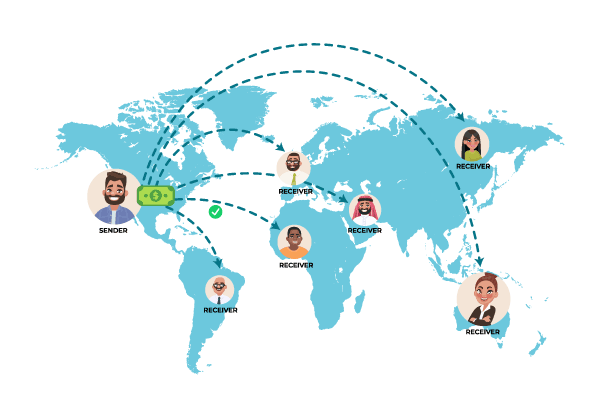

Wire Transfer

Wire Transfer Online is an electronic method to send money between financial institutions. Zil.US offers quick wire transfer processing with low fees for international and domestic transfers. Codes like SWIFT or IBAN are needed for international transfers, while domestic transfers require routing and account numbers. Zil.US ensures secure transactions for both types of transfers.

Online Payments

Zil.US provides secure and simple online payment options such as ACH, wire transfers, virtual cards, RTP, and more. This simplifies payments for businesses and individuals, saving time and improving efficiency. Additionally, Zil.US offers hassle-free bill and client payments through mobile platform.

All-In-One Platform

Zil.US is your go-to for all business needs, offering top-notch small business accounts and various payment options, including ACH payments, wire transfers, mail checks, and more.

FREQUENTLY ASKED QUESTIONS

What is ACH?

ACH, or Automated Clearing House, is the U.S. system for electronic payments and transfers. Using Zil.US, you can make ACH transactions at an affordable cost.

What is ACH transfer?

ACH transfers are electronic bank-to-bank payments in the United States through the ACH network (Automated Clearing House). Funds move from one account to another with the help of a centralized system that directs funds to their destination. The National Automated Clearing House Association (NACHA) controls ACH transfers. With the recurring ACH facility on Zil.US, you can make regular payments to your payees or collect payments from clients before due dates.

How to do a wire transfer?

To start a wire transfer, you usually give your account the recipient's account details and any needed reference info, then approve the transfer online, by phone, or in person. Use Zil.US for quicker and easier wire transfers from your smartphone or computer.

ACH vs Wire

ACH transfers are electronic transfers between banks that typically take 1-3 business days to process. They are commonly used for domestic payments like direct deposits or bill payments. Wire transfers are faster and usually completed within the same business day, but they come with higher fees and are often used for urgent or international transactions. Zil.US offers affordable ACH and wire transfers.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.