A payroll card system can help save processing expenses for your company while making it simpler for employees to access their paychecks. If you have many workers without bank accounts who travel frequently or work in remote regions, you might need payroll cards. Although direct deposits are more affordable, they are less useful to those without bank accounts.

Zil.US allows users to create payroll cards for their employees under one bank account and instantly transfer funds to their accounts. Many businesses are now benefiting from this feature and saving a lot of money by issuing payroll cards.

What Is The Need For Payroll Cards?

According to one estimate, the number of American consumers without bank accounts is around 30 million. For these workers, there aren’t many options available for receiving their pay. Payroll cards are frequently more affordable than processing and printing paper checks, despite pricing variations. They also take care of the problem of misplaced or stolen checks.

In addition, payroll cards offer a number of other benefits. They can help employees manage their finances and budget better and provide employers with valuable data about employee spending patterns. As more and more consumers move away from traditional banking relationships, payroll cards are likely to become an increasingly popular payment option.

Benefits Of Payroll Cards For Businesses

Payroll cards, an intuitive, streamlined method of providing workers with rapid access to their paychecks, are already widely adopted by businesses as part of their paperless payroll concept.

Here are some of the top benefits of payroll cards for business owners.

- No Need For Paper Checks

While paper checks may be the traditional payment method for many businesses, they can come with several hidden costs. In addition to the expense of the paper, envelopes, and ink, there is also the time and labor required to print and distribute the checks. This can be especially costly if you include in the time and effort your account department spends on the procedure. Payroll cards can save you time and money, up to a few dollars per employee every pay cycle.

- Increased Flexibility

You may use the same card solution for various types of payments, such as incentives or expenses, and they integrate effortlessly with existing systems. Managing payroll with a paper-intensive method can be challenging if you have a variety of workers with varied pay cycles. Payroll cards can be used to pay hourly workers, monthly workers, contractors, freelancers, or any other type of worker. The cards you use and the steps you take will be precisely the same.

- Improve Employee Satisfaction

Payroll cards provide your employees with a better payment experience, which is something that is valuable. The time when people had to stand in line just to get their salary and then cash it in is long gone. On payday, money is accessible right away, and employees are paid instantaneously. Additionally, card options promote financial inclusion and draw in more potential employees, especially those without bank accounts. It’s an appealing bonus to prospective employees, and it motivates your current staff by offering a payment procedure that better suits them.

- Reduce The Risk Of Fraud

Despite the rising incidence of check fraud, companies using technology are able to minimize or even completely remove the dangers. Payroll cards can easily be revoked and issued again if they are misplaced or stolen. Additionally, unlike checks, payroll cards don’t include sensitive data like bank account numbers or personal identifiers. A payroll card can also be used digitally using a mobile app,

Create Payroll Cards With Zil.US

Zil.US offers employers a convenient and efficient way to pay their employees. This cloud-based banking platform makes it easy for employers to instantly send funds to their employees.

With Zil.US, employers can create a payroll card for their employees under one bank account. This allows employers to transfer funds instantly to their employees’ accounts. A physical payroll card will be sent to the employees, and they can use it to withdraw funds. This system is efficient and easy to use and eliminates the need for paper paychecks.

As a result, Zil.US is a valuable tool for employers who want to streamline their payroll processes.

How To Create Payroll cards With Zil.US?

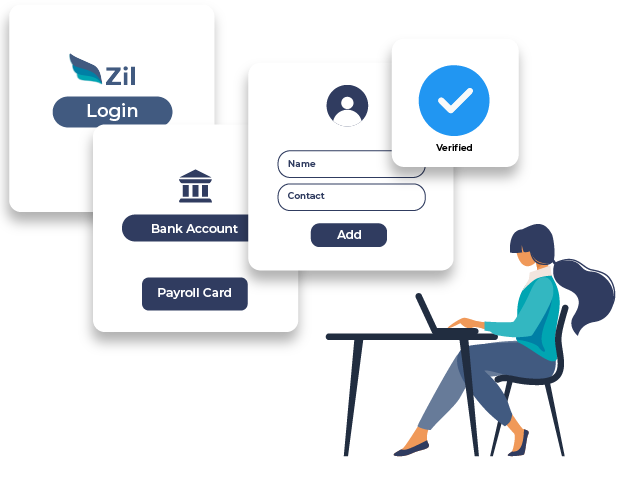

Employers can create payroll cards with Zil.US in three easy steps.

- Log in to your Zil.US account.

- Select a business bank account that you already added and click on the Payroll Card button.

- Add the contact and ID details of your employees.

An account will be created for the employees following ID validation and approval. They can now use their phone number to access Zil.US from a computer or mobile device.

As payroll cards are becoming a more and more popular way for businesses to manage their payroll, employers can use Zil.US to create payroll cards for all of their employees. This feature is saving many businesses a lot of money by issuing payroll cards instead of checks. If you’re looking for an easy and efficient way to pay your employees, consider using a payroll card from Zil.US.