Bank account numbers are a crucial component of the modern banking system. These unique identifiers are assigned to individual bank accounts to ensure that transactions are accurately processed and credited to the correct account. Opening an account at Zil.US will get you a bank account number. Whether you’re a seasoned banking professional or just starting with your first bank account, understanding the importance of bank account numbers is essential for navigating the world of modern finance.

Bank Account Number Overview

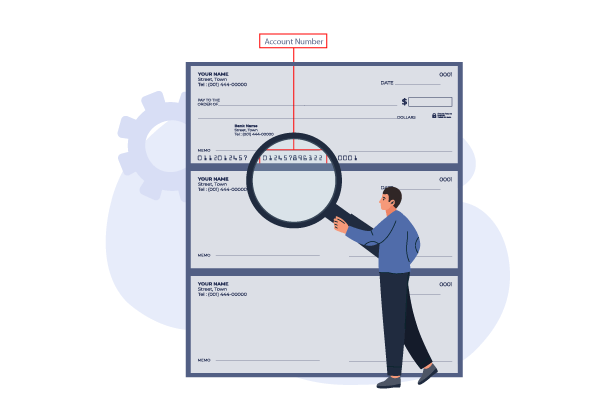

A bank account number is a unique identifier assigned to a bank account by a financial institution. This number is used to identify the account and facilitate financial transactions such as deposits, withdrawals, and funds transfers. Bank account numbers can vary in length and format depending on the country and the financial institution.

Why Bank Account Numbers Matter?

Bank account numbers are important because they help ensure financial transactions are processed accurately and efficiently. When you provide your bank account number to a third party, such as an employer or a utility company, they use it to initiate transactions to your account. If you provide the wrong account number, the transaction may be rejected or go to the wrong account, which can cause significant issues.

In addition to ensuring the accuracy of transactions, bank account numbers are also used for security purposes. Banks use account numbers to verify the account holder’s identity and prevent fraud. When you log in to your bank account online, you may be asked to provide your account number and other security information, such as a password or PIN. Zil.US also protects your account with the same measures.

What Is an International Bank Account Number (IBAN)?

The international bank account number, or IBAN, is a unique identifier for a foreign bank account. The first two digits represent a country code, followed by two additional numbers and a string of letters and numbers. An international bank account number (IBAN) supplements a bank’s existing account number to identify monetary transactions made abroad.

Bank Account Numbers In the USA

Bank account numbers can come in different formats depending on the country and the financial institution. In the United States, most banks use a nine-digit number called a routing number to identify the bank and a unique account number to identify the specific account. In other countries, account numbers may be longer or shorter and may include letters as well as numbers.

In the United States, bank account numbers are typically between 8 and 12 digits long. The specific format of a bank account number can vary depending on the financial institution and the type of account. However, most bank account numbers follow a similar format.

Protecting Your Bank Account Number

Because bank account numbers are sensitive information, protecting them from unauthorized access or disclosure is important. Never share your bank account number with anyone unless you trust them and have a legitimate reason to do so. Be especially wary of unsolicited requests for your bank account number, as these may be scams or attempts at fraud.

In addition to keeping your bank account number private, monitoring your account regularly for any unauthorized transactions or suspicious activity is also a good idea. Most banks offer online access to account information, which makes it easy to check your account balance, view transactions, and report any issues.

Benefits of Bank Account Numbers

Bank account numbers serve several important purposes in the US banking system. First and foremost, they are used to identify individual accounts and ensure that transactions are credited to the correct account. This is especially important for electronic transactions, such as direct deposit of paychecks or automatic bill payments.

In addition, bank account numbers are used for various other purposes. For example, they may initiate wire transfers or authorize ACH (Automated Clearing House) transactions. They may also be used for online banking, where customers can view their account information and initiate transactions.

Another important use of bank account numbers is for fraud prevention. By requiring a unique account number for each customer, banks can ensure that only authorized individuals can access their accounts. This helps to prevent unauthorized transactions and protect customer funds.

Bank account numbers play a vital role in the functioning of the modern banking system. These unique identifiers help ensure that transactions are accurately processed and credited to the correct account while also serving as a tool for fraud prevention and customer protection. Whether you’re setting up a new bank account, initiating a wire transfer, or simply checking your account balance online, understanding your bank account number is essential for conducting financial transactions with confidence and security. Open an account at Zil.US without any hidden fees, maintenance fees, or minimum balance requirements.