Best Checking Account Online

Best Checking Account Online can lead your business forward. The cloud-based platform lets you open a free checking account for your business financial transactions. There are no minimum balance requirements, monthly deposit charges, maintenance charges, or any other hidden fees for opening checking accounts.

Zil.US is a financial technology company, not a bank. Zil.US offers banking services through partnership with FDIC member banks Texas National Bank. Customers are not directly insured by the FDIC - but through the pass-through coverage of our partner banks and is conditional on proper titling, record-keeping, and custodial arrangements.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Effortless Checking Account Services

Zil.US offers a safe and effortless checking service for smart business payment processing. Experience the best online checking account with no hidden charges like other banks.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

One-Stop Solution

Zil.US offers a free business checking account with all your business’s required payment services. Enjoy customizable corporate expense cards, gift cards, wire transfers, and more on one platform.

Business Expense Card

Zil.US’s corporate expense card streamlines expense tracking and improves spending control. Businesses may distribute payments to staff, track costs in real-time, and establish spending limitations for categories or people with the Zil.US business expense card. The card may be used for business travel, entertainment, and supplies, making it a versatile tool for financial management. Businesses may improve spending awareness and make choices with immediate alerts and thorough cost reports. The Zil.US, business expense card, promotes responsible spending and simplicity, helping firms reduce expenditures and enhance financial management.

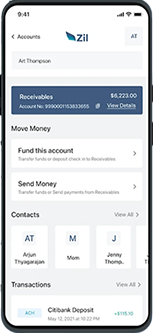

Multiple Checking Account

Small business owners benefit from having a dedicated checking account for their business. This separate account offers legal protection and helps clarify personal and business expenses, leading to better financial management accuracy. Separating business funds also makes tracking transactions easier, boosts credibility, and simplifies access to financial tools like loans and credit cards for business growth. With Zil.US, you can easily create multiple accounts for various purposes.

FREQUENTLY ASKED QUESTIONS

What is Best Checking Accounts online?

A checking account from Zil.US is the best online checking account. You can use the funds as you need to, without any restrictions.

What bank can I open a checking account online?

Zil.US has the best online checking accounts, and you can open the account without any hidden fees.

Online Checking Account vs Traditional

Online checking accounts typically offer higher interest rates and lower fees than traditional brick-and-mortar banks. In contrast, traditional checking accounts often provide in-person customer service and access to physical branches for those who prefer face-to-face interactions and additional services. Zil.US offers the best checking accounts, making it easy and safe to manage your business transactions.

Checking Account or Savings

A checking account is designed for frequent transactions and easy access to funds. It often offers features like cards and check-writing capabilities, making it suitable for everyday spending and bill payments. On the other hand, a savings account typically offers higher interest rates. It is intended for storing money over a longer period, helping individuals accumulate funds for future goals or emergencies while limiting frequent withdrawals. Zil.US offers the best checking account online with no hidden fees.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.