Multiple Business Checking Accounts

Multiple Business Checking Accounts can be opened with the cloud-based platform to simplify business finances. Easily manage sending and receiving payments, track expenses and organize funds from a single user-friendly interface. Also, enjoy affordable payment options including ACH, wire transfer and check mail.

Zil US powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Benefits of Having Multiple Business Checking Accounts

A business checking account can be really helpful in handling various expenses and improving financial processes. By having multiple business checking accounts, users can separate funds for different purposes. Keep accounts payable and receivable accounts separate for easier tracking of payments and reduce risks.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

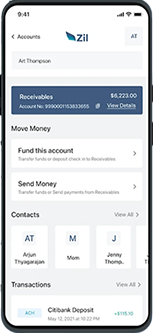

Open Business Checking Account Online

Zil.US makes it easy to open a business checking account online. All you have to do is sign up with the platform or download the mobile app from Play Store or Apple App Store. Once your account is verified, you can start managing your business finances, making payments, and handling transactions with ease. The process is fast, secure, and designed to fit the needs of modern businesses.

Corporate Expense Card

Businesses can create corporate cards through Zil.US to better manage spending and improve expense tracking. These cards can be used to monitor how employees handle business funds and ensure that spending stays within budget. You can also set spending limits and review all transaction data from the Audit Log.

Easy to Access

High Security

Easy Payment

Online Payments

Small businesses need an affordable and efficient online payment platform for sending payments and managing transactions. Zil.US allows users to open free checking accounts, make payments via ACH, wires, check mail and pay from a wallet. It is a complete payment solution offering flexibility to users. The platform is also highly secure and makes domestic and international payments easy.

FREQUENTLY ASKED QUESTIONS

Which checking account is best?

Zil.US offers a fee-free checking account to users with zero monthly fee, maintenance fee and minimum deposit requirements. You can also send ACH and wires at affordable costs through the cloud-based platform.

Can I open checking account online?

Yes, you can open a checking account online with Zil.US. All you have to do is sign up and provide some basic details. Once verified, you can start making payments and transferring funds without hassle.

Are all checking accounts free?

No. While all checking accounts might not be free, Zil.US offers a truly free checking account for businesses, with no monthly maintenance fees or hidden charges.

Checking Account vs Savings Account

A checking account is used to handle regular transactions and day-to-day payments while a savings account is for saving money over a period of time. Zil.US allows you to open multiple fee-free checking accounts online.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.