Online Business Payment Solution

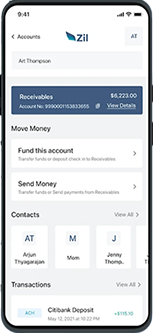

Online Business Payment Solution is essential for every growing business. The platform provides an all-in-one platform for your online business payment needs. With this cloud-based payment platform, you can send money instantly between Zil.US accounts and transfer funds via ACH or wire transfer at a low cost. The platform also offers fee-free business checking accounts with no hidden charges.

Zil.US is a financial technology company, not a bank. Zil.US offers banking services through partnership with FDIC member banks Texas National Bank. Customers are not directly insured by the FDIC - but through the pass-through coverage of our partner banks and is conditional on proper titling, record-keeping, and custodial arrangements.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Customized Expense Card

Zil.US provides small businesses with customized expense cards for managing employee costs. Thus, companies can offer their employees cards to manage expenses that they can customize based on their expenses.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

Open a US Checking Account Anywhere in the World

Opening a US payment account online is a great way to expand your company’s reach in the United States. With a US account, you can accept US dollar payments without losing money to exchange rates. Opening a US business account with Zil.US allows you to open an account from anywhere without being physically present in the USA.

Multiple Checking Account

Businesses can create multiple accounts using Zil.US, making managing funds easier. The platform allows you to manage personal and company costs or organize your finances. Multiple accounts allow you to allocate each payment account for various purposes.

Easy to Access

High Security

Easy Payment

No More Hidden Fees

Zil.US provides hassle-free checking with no fees or hidden charges. The cloud-based platform eliminates monthly service fees and minimum balances for checking accounts. Platform’s transparent and customer-focused payment solution approach enables you to concentrate on your financial goals without concerns about hidden expenses.

FREQUENTLY ASKED QUESTIONS

Are checking accounts free?

Traditional banks usually charge a monthly maintenance fee for checking accounts, but Zil.US doesn't charge any fees for opening one. Businesses can open an account on this cloud-based payment platform without deposit fees.

Can I open a business account online?

Yes, you can open a business payment account online with Zil.US for free.

Which platform can I open a checking account online?

Zil.US offers the best online checking accounts with the added benefit of opening an account free without any hidden fees.

Business Account vs Personal Account

A business checking account is specifically designed for managing finances related to business operations, offering features tailored to business needs, such as invoicing and expense tracking. A personal checking account is intended for individual use, typically offering standard payment services like savings and checking with fewer business-oriented features. Zil.US offers both business and personal accounts.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.