Open Business Checking Account Online

Open Business Checking Account Online to enjoy cost savings, ease of use, and quick access to funds. Easily take care of your business payment needs with a fee-free checking account with zero maintenance fee and minimum balance requirements. Access your account from any device at any time. Make use of affordable ACH and Wire transfers to pay vendors with ease.

Zil US powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Open a US Checking Account Anywhere in the World

Zil.US makes it easy for businesses to accept payments from American customers without the hassle of being there. You can open a US business payment account online, wherever you are in the world. This means you can send and receive money within the US quickly and easily. Plus, getting paid in US dollars saves you money on currency exchange fees. With Zil.US, you can offer more payment choices to your customers, which helps you reach more people.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

Corporate Expense Card

Zil.US’s corporate expense cards give businesses total control over employee spending. By setting spending limits on each card and tracking purchases in real-time, companies can gain valuable insights into spending habits. This approach helps businesses make smart adjustments to their expense policies, saving money and boosting efficiency.

One Stop Solution

Zil.US is a complete payment solution that offers the best financial tools and services to small and medium sized businesses. Users can make international and domestic wires, send gift cards and manage ACH transfers all in one place. The cloud-based platform makes financial management easy and efficient.

Easy to Access

High Security

Easy Payment

Instant Business Payment Solution

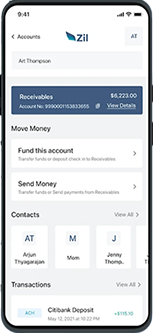

Zil.US transforms business finance with instant transfers between Zil.US accounts, offering free online account setup and easy access to affordable payment services. Users can manage supplier payments, client transactions, and daily expenses seamlessly. Opening a Zil.US account online is straightforward and free of hidden fees.

FREQUENTLY ASKED QUESTIONS

Can i open a business checking account online?

Yes, you can open a free business checking account online with no deposit with Zil.US. All you have to do is sign up, add business information and upload some documents for verification. Once your account is set up, you will have access to affordable ACH and wire transfers, among other payment solutions.

What documents do i need to open a business account?

Zil.US allows users to instantly open a business checking account online. You can upload relevant business information, business documents and personal identification documents easily from any device. The mobile app makes it easier to handle business payments on the go.

How much to open a business account?

You can open business account online for free with Zil.US. The cloud-based platform charges zero maintenance fee and has no minimum balance requirements. There are no hidden fees, so businesses don’t have to worry about additional costs.

Business Account vs Personal Account

Business account is used to manage business revenue and expenses while a personal account is for individual financial management. Zil.US allows users to open business checking account online to efficiently handle business finances.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.