Payment Solution

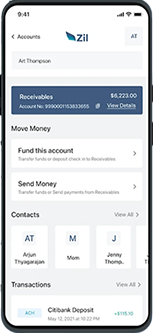

Payment Solution is crucial for businesses, and the platform offers a modern checking account solution tailored for small businesses and freelancers. Users can open checking accounts with no minimum balance, no account costs, and no monthly fees. Additionally, the platform enables convenient money transfers through ACH and wire transfers at affordable rates. This seamless, cost-effective solution simplifies financial management, allowing businesses to focus on growth and efficiency.

Zil.US is a financial technology company, not a bank. Zil.US offers banking services through partnership with FDIC member banks Texas National Bank. Customers are not directly insured by the FDIC - but through the pass-through coverage of our partner banks and is conditional on proper titling, record-keeping, and custodial arrangements.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Online Payment

Zil.US offers 24/7 access to accounts and transactions from anywhere with an internet connection, eliminating the need for physical bank visits and saving time. This online payment platform provides enhanced control over finances, allowing users to monitor balances, track expenses, and set transaction alerts. It supports efficient fund transfers, bill payments, and easy access to account statements, streamlining financial management. Advanced security measures, such as two-factor authentication and encryption, ensure the safety of sensitive information and financial assets.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

Open Multiple Accounts

Use Zil.US to create and manage multiple accounts in one convenient place. Open several checking accounts with no minimum balance and no hidden fees, simplifying your financial operations. The platform also helps you seamlessly organize and monitor all your banking documents, providing a comprehensive solution for efficient financial management.

Corporate Expense Card

Zil.US’s corporate expenses card streamlines staff spending management, making it easier for businesses to control expenses and track transactions in real time. Employees can use the card for business expenses such as travel and supplies, eliminating the need for hefty cost reports or reimbursements. This expense card simplifies cost management, helps prevent fraud, and saves both time and money, providing an efficient and secure solution for corporate expense control.

Gift Card

Zil.US offers a convenient gift card solution that can be instantly delivered to anyone on your contact list via email. Recipients can use this virtual card to make purchases at any store that accepts gift cards, providing flexibility and ease of use. Businesses can effortlessly send gift cards to clients or employees for any occasion, with no limit on the number of recipients.

FREQUENTLY ASKED QUESTIONS

How does a gift card work?

Zil.US's activated gift cards function just like cash, allowing recipients to make purchases wherever the card is accepted, both online and in stores. This versatile payment option provides the convenience of cash with the ease of a card, making it a perfect gift or reward for any occasion.

Where is best to open an online checking account?

Zil.US is the best place to open an online checking account with no initial fee. Users can enjoy instant money transfers, ACH, and wire transfers at a lower cost. Zil.US provides a comprehensive, one-stop accounting solution for businesses conveniently accessible from the office or home. This platform streamlines financial management, making it easier for businesses to handle their finances efficiently and cost-effectively.

Which checking account is best?

Zil.US provides a free checking account with no monthly fees or minimum balance requirements. The platform offers seamless instant money transfers via ACH and wire transfers at a lower cost, ensuring efficient financial management for individuals and businesses.

Checking vs Savings Account

A checking account is ideal for frequent transactions and day-to-day expenses, providing easy access to funds through checks, cards, and online transfers. On the other hand, a savings account is designed for long-term money storage. It often earns interest on the balance while restricting access to funds to promote saving habits.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.