Best Business Checking Account

Best Business Checking Account is here to ease your payment experience. Sign up today to open online checking account for business in just minutes, regardless of your business type – Corporation, LLC, or Sole Proprietorship. The cloud-based payment platform offers the best company account solution with no minimum balance requirements or monthly fees for accounts for business. Open a company checking account, simplify financial management, and use business checking accounts for seamless transactions. Whether you need domestic or international capabilities, the platform supports same-day ACH and Wire transfers. Choose convenience and efficiency for your business with our checking accounts for business.

Zil US powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Why Should You Have a Separate Checking Account for Your Small Business

Opening a dedicated checking account for your business is important as a small business owner. Whether you’re doing business as LLC or a corporation, a separate online checking accounts for business finances helps to protect you legally. In addition, it helps to separate business and personal expenses and manage business finances more accurately.

A dedicated small business account benefits you as:

- It helps to safeguard your business funds by separating your finances

- It makes it easier to monitor business finances and spending

- Promotes better bookkeeping habits that help keep business finances organized

- It can help you to get a business loan, line of credit, or business credit card when you need one

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

A Fee-Free Online Small Business Checking Account

At Zil.US, you can enjoy all business payment features to help you scale your small business with us. We offer the best online checking accounts for business with no hidden fees. You don’t have to worry about any minimum balance requirement or monthly fees. Moreover, you can open a Zil.US online checking account at zero initial deposit fees. Move money seamlessly with our same-day ACH and Wire processing.

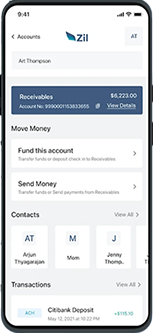

Multiple Business Checking Account

Zil.US lets you open multiple business checking account, giving you the freedom and power you need. The platform’s multiple business checking account feature can help you with various financial needs. If you have more than one account, you can use each one for a different task, like keeping track of your income, managing your spending, or setting money away for taxes. Furthermore, managing multiple accounts carefully builds a history of good money management, which can be good for the growth and security of your business.

Easy to Access

High Security

Easy Payment

One Stop Solution

Zil.US is the best place for your personal and business payment needs. The platform offers a wide range of services, making payment easy and quick. The easy-to-use mobile app allows you to check your account for free, get early direct pay, and use expense cards.

FREQUENTLY ASKED QUESTIONS

What is the best checking account for a business?

When looking for a checking account to open a small business, you should look into fees, ease of accessibility, and customer support. Zil.US provides small business owners with the best online checking account with no minimum balance requirement or monthly fees. In addition, you can access your account anywhere, anytime, with mobile online access. The platform also provides dedicated 24/7 human customer support via chat or call.

How to open a business checking account?

You can open a business checking account for your business by providing your documents like a business license, tax ID number, and proof of EIN (Employer Identification Number). The platform verifies your information and sets up your account. You can open a US checking account remotely from anywhere on Zil.US.

What do I need to open a business checking account?

A business saving account can help save money and earn interest. It can be used for unexpected expenses or downturns in business and can also be used for tax payments. In addition, a small business account generally has monthly fees waived. On the other hand, a business checking account is used for day-to-day transactions like purchases or bill payments. Open a business checking account on Zil.US today.

Business Checking Account vs Saving Account

A business saving account is used to save money and earn interest. It can be used for unexpected expenses or downturns in business and can also be used for tax payments. A small business account generally has monthly fees waived. On the other hand, a business checking account is used for day-to-day transactions like purchases or bill payments. Zil.US provides the best business checking account with no minimum balance requirement.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.