Get Paycheck Early

Get Paycheck Early! Enjoy instant transfers between Zil accounts. Pay your employees without any delay. Affordable and immediate ACH, wire transfers, and RTP payment services for enhanced transactions. Open a business checking account with the software for a fee-free payment solution with no hidden fees. The platform eliminates maintenance charges and initial deposits for user-friendliness.

Zil is a financial technology company, not a bank or an FDIC member. Zil offers banking services through partnership with FDIC member banks Silicon Valley Bank and Texas National Bank.

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

How to Get Your Paychecks Early?

Zil receives a notification from the Federal Reserve when your employer’s payroll information is processed. Once this confirmation is received, Zil initiates the Direct Deposit. Essentially, as soon as your employer’s payment is available, the platform starts transferring funds into your checking account. This process reduces the processing time, allowing you to receive your paychecks early.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.US!

Gift Card

Effortlessly gift with Zil. Email gift cards to any contact for use at any store. Ideal for all occasions and unlimited recipients.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.US.

Pay Bills Early

Getting paychecks earlier than your payday will help you pay bills early. With Zil’s faster Direct Deposit, you will get access to your paychecks before traditional banks.

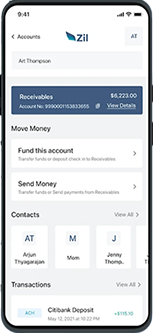

Effortless Checking Account Services

Zil provides businesses with convenient checking account services that meet their needs. In addition to the online payment solution, the platform has services that make business processes easier. ACH payments make it easy to transfer money, and Zil becomes a single platform for companies, making it easier to manage their finances and run businesses more efficiently.

Easy to Access

High Security

Easy Payment

No More Hidden Fees

Zil offers accessible, assured, and affordable checking accounts with no hidden or maintenance fees. When you use Zil’s online payment features, you can enjoy the benefits of a checking account without thinking about extra charges. The platform eliminates minimum balance requirements, and you do not have to pay monthly service fees.

FREQUENTLY ASKED QUESTIONS

What is direct deposit?

A Direct Deposit helps you transfer funds electronically from one checking account to another. Businesses can use direct deposit to pay employees' payroll directly into their accounts. Zil's online payment solution offers the get paid early feature, which deposits paychecks early from payday directly into an employee's account.

How to set up direct deposit?

To set up a direct deposit, you should provide the account number and routing number. To initiate the process, select the bank account and enter the deposit amount. Select the account from which the payment needed to be made and your payee's account too. Provide the information asked, such as the issue date and email address, and click on "ACH Now." Your payment is made. Payment can be made in person or online. Zil's online payment solution allows direct deposits through eChecks, ACH, wire transfer, and RTP. You can set up one-time or recurring ACHs or manage employee payroll with the software.

How to get paycheck early?

To get the paycheck early, set up a direct deposit with Zil. The platform gets a notification from the Federal Reserve as soon as it processes your employer's payroll information. After getting confirmation, Zil executes the direct deposit into the account.

Direct Deposit vs Wire Transfer

Direct deposits let you transfer money domestically from one account to another at regular intervals within the U.S. such as payroll checks. However, wire transfers are available worldwide and are used to transfer money domestically and internationally.

Make Business Easy with Zil

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.