Technology continues to have a direct effect on how people handle their finances and how organizations function in the ever-changing financial sector. Mobile check deposit are one such development that has attracted a lot of attention. This cutting-edge technology is revolutionizing financial transactions for companies all around the world, in addition to payment operations in the United States.

Empowering Small Businesses with Mobile Check Deposits

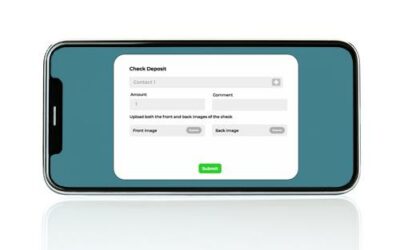

Mobile check deposits have changed the game for small businesses. It’s super easy and fast. Now, business owners can deposit checks without going to the bank. This is all thanks to cloud-based technology. So, companies can work better, with more money coming in quickly and resources available sooner.

Stand Out with the Best Fintech Partner

Among the wide range of fintech platforms available, Zil.US distinguishes itself with its comprehensive suite of services tailored specifically to meet the needs of modern businesses. One standout feature is the fee-free business checking account, which allows businesses to better manage their finances.

Optimized Global Accessibility

Zil.US goes beyond domestic borders, offering a unique service that enables individuals and businesses to create US bank accounts from anywhere in the world. Freelancers, remote workers, and foreign businesses in need of a US bank account for business purposes will find this level of global accessibility to be very helpful.

In addition to its extensive web platform, Zil.US makes it simple for users to manage their cash anywhere regardless of their location. It gives businesses the features they need to grow and succeed in the global economy by offering a practical and effective solution. With state-of-the-art features like mobile check deposits at their fingertips, users can navigate the digital landscape with ease and confidence.