Free Checking Accounts

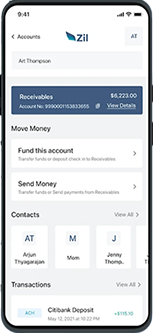

Free Checking Accounts for your business payment needs are now available easily. You can open your free checking account with no minimum balance requirements, no minimum deposit amount, and zero monthly maintenance fee. Access your funds easily and expand your business without any worries. Businesses can enjoy convenience by taking control of their finances. You can also enjoy ACH and Wire Transfers at the most affordable cost whenever and wherever you need them.

Zil US powered by Zil Money is a fintech, not a bank. FDIC coverage is provided through our partner banks Texas National Bank and Lincoln Savings Bank.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We Offer You the Best

0

initial fee

No initial fees or hidden fees to open an account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your payment journey with zero minimum deposit.

0

initial fee

No initial fees or hidden fees to open account with us.

0

maintenance fees

Enjoy hassle-free payment services with no maintenance fees.

0

minimum deposit

Start your Payment journey with zero minimum deposit.

Open Multiple Accounts

With Zil.US, open multiple checking accounts without minimum balances or hidden fees. Easily create and manage numerous accounts in one place while effortlessly organizing and monitoring all your payment documents.

SERVICES

Experience the power of next-generation cloud payment solutions at Zil.US SaaS platform, revolutionizing the financial industry

Payment Platform

Enjoy US payment experience online at zero hidden fees and streamline your operations from anywhere, anytime.

ACH

Enjoy a smooth and efficient process for ACH payments, free of complications at low transaction costs.

Payroll Card

Experience endless convenience, instant access to funds, and enhanced security with Zil.us’s payroll card.

Wire Transfer

Send or receive funds domestically or internationally with the wire transfer service with minimal transaction charges.

Pay by Phone

Send money using your phone number seamlessly and discover the convenience of Zil.us!

Virtual Card

Access your virtual card from your smartphone, just like a physical card, and make secure and simple payments easily.

API

Enhance Services with Virtual and Gift Card APIs! Create unlimited cards and set spending limits. Empower business with Zil.us.

Open a US Checking Account Anywhere in the World

Set up a US account remotely and grow your business faster in the USA with Zil.US. A US account number allows you to receive US dollars without losing the exchange rate. You do not have to pay more expensive foreign exchange fees. Also, opening an account in the USA will allow you to access more resources. Get a high-security payment account level to protect all accounts to ensure your money is safe.

Corporate Expense Card

Zil.US’s corporate expenses card simplifies staff spending management, allowing businesses to control and track transactions instantly. Employees can use the card for business expenses such as travel and supplies, eliminating the need for cost reports or reimbursements, thereby streamlining cost management, preventing fraud, and saving time and money.

FREQUENTLY ASKED QUESTIONS

What's Checking Account?

A checking account is a type of bank account that allows individuals to deposit and withdraw funds frequently, often offering features like check-writing, card access, and online payment services. Zil.US's fee-free business checking account offers the best banking with instant money transactions, ACH, and wire transfers.

What's Checking Account Number?

Your checking account number is at the bottom of your checks, positioned between the nine and 12-digit numbers, depending on the number of accounts you have with the bank. Zil.US offers a free online checking account with no hidden fees.

Checking vs Savings Account

A checking account is perfect for frequent transactions and daily spending, providing easy access to funds through checks, cards, and online transfers. In contrast, a savings account is meant for saving money over time, usually offering higher interest rates and fewer withdrawal options to encourage saving for future goals or emergencies. Zil.US offers SMEs the best online payments with no minimum deposit fee and zero monthly maintenance fees.

Online Checking Account vs Traditional

An online checking account operates mainly through digital channels, offering features like online bill payment, mobile check deposit, and often higher interest rates. On the other hand, traditional checking accounts usually involve physical branches and may have higher fees but offer in-person payment services and access to ATMs.

Make Business Easy with Zil.US

At Zil.US, we pledge to provide convenient and efficient services to our customers to make business operations easier.