In today’s fast-paced business environment, the need for flexible and secure financial solutions is of much importance. Small businesses, both domestically and internationally, are increasingly turning to virtual card options to simplify transactions and optimize their financial operations. Among these options, As a great alternative to Skrill virtual card, Zil US has gained prominence for its accessibility and convenience.

Unlocking Versatility for Small Businesses

The alternative to the Skrill virtual card, Zil US, presents small businesses with a versatile payment solution, allowing them to make online purchases, manage expenses, and facilitate transactions with ease. With its user-friendly interface and robust security measures, the Skrill virtual card alternative, the cloud-based platform, empowers businesses to navigate the digital landscape confidently, eliminating the constraints of traditional banking methods.

A Comprehensive Fintech Solution

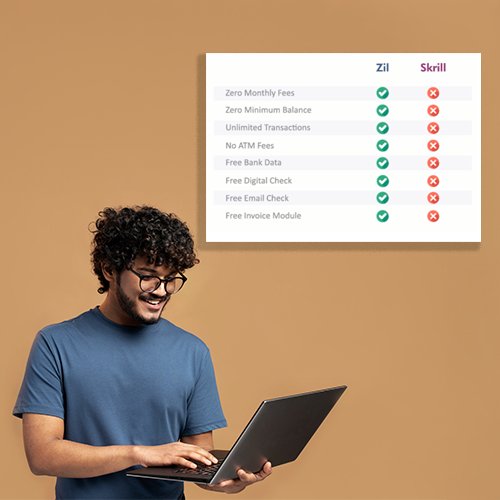

Amidst the array of fintech platforms, Zil US emerges as the premier choice for individuals and businesses. Offering a one-stop solution for all financial needs, it stands out as a beacon of innovation in the industry. Unlike most alternatives in the market, provides a cloud-based banking service that prioritizes convenience and efficiency. With no minimum balance requirements or hidden fees, this all-inclusive financial solution ensures transparent and cost-effective banking solutions.

Smooth Integration and Enhanced Functionality

Zil US distinguishes itself by offering smooth integrations and enhanced functionality tailored to modern business demands. From instant visa cards to payroll management and tax services, it covers a spectrum of financial needs under one platform. Small businesses benefit from features such as free checking accounts, physical and virtual debit cards, and comprehensive online banking capabilities, empowering them to thrive in today’s competitive landscape.

Elevating Efficiency and Accessibility

With Zil US, small businesses gain access to advanced financial features designed to elevate efficiency and accessibility. Whether sending and receiving payments via ACH or wire transfer, it ensures swift transactions at minimal costs, enabling businesses to optimize their financial operations. Moreover, its mobile-friendly interface allows users to manage their accounts on the go, ensuring easy connectivity and convenience.

In the evolving landscape of financial technology, small businesses require agile solutions to navigate complexities and drive growth. These alternatives to the Skrill virtual card offer a glimpse into the possibilities of virtual payment options, while Zil US emerges as the best fintech, providing unparalleled innovation and convenience. With its comprehensive suite of services and commitment to excellence, it remains the optimal choice for businesses seeking to unlock their full potential in the digital age.